There are investment services that are easy to pigeonhole and then there are the more awkward firms to categorise and Netwealth tops that list. It’s a digital wealth manager, with clever discretionary portfolios, meaning you pick the one that suits you best and the experts run it for you, buying and selling on your behalf to deliver the strategy. So often, people spend forever picking investments they hope will do well for them, but the ongoing buying and selling to keep the portfolio performing becomes daunting and often neglected altogether.

There are investment services that are easy to pigeonhole and then there are the more awkward firms to categorise and Netwealth tops that list. It’s a digital wealth manager, with clever discretionary portfolios, meaning you pick the one that suits you best and the experts run it for you, buying and selling on your behalf to deliver the strategy. So often, people spend forever picking investments they hope will do well for them, but the ongoing buying and selling to keep the portfolio performing becomes daunting and often neglected altogether.

Netwealth also has real financial advisers on hand to deal with any worries or concerns you have, either on an ad hoc basis, or on retainer. Specific financial advice is charged at £200 per hour and ongoing portfolio advice is charged at 0.2% of your portfolio, with a minimum of £1,000 per year.

It’s pricey, but the important thing is that it’s there if you need it, and trying to get advice from elsewhere is exceptionally difficult at present. There aren’t enough financial advisers in the UK to meet demand and at the right price point. Netwealth’s advisers can only advise on the investments available at Netwealth, but that’s no bad thing because the portfolios they offer cover almost every need. If you don’t need the advice, then you don’t pay for it.

First impressions

First impressions of the site are good. I’ve registered for free, which allows me to have a good poke about and see both the content and the planning tools, but not a sample portfolio. (Note to all platforms – it is really useful to show prospective clients what you’ll have in terms of portfolio management once you’re up and running. Even a screen grab would be a start.)

In fact, once you’re logged in the user interface is a lot simpler and clearer than when you’re in the standard site, which is trying to achieve too much in a very cramped and verbose way.There are some useful tools, planners and tutorials on the site too, if you’re happy to select your own portfolio and keep an eye on it.

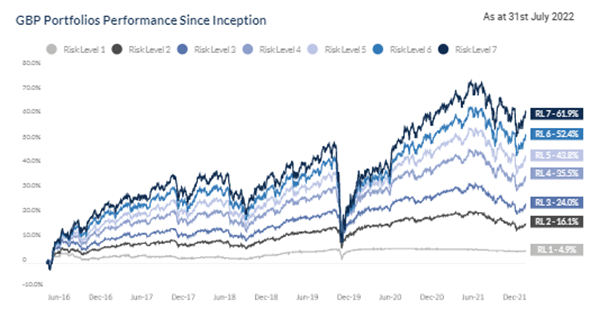

When it comes to the investment choice there are effectively seven portfolios on a scale from low to high risk – no shocks here, everybody offers similar – but performance seems to be consistent and in line with what you’d expect. So, big tick here. Unlike other online discretionary managers, Netwealth does not ascertain your tolerance for risk with a risk questionnaire, so it’s down to you to pick the portfolio that you feel most comfortable with.

Here’s a graph of performance for the seven standard portfolios.

Over the same period, the FTSE 100 index grow by 20.75%, so only the lowest risk portfolios underperformed this index, even taking into account a pandemic and the Ukraine war. Investments are primarily in passive funds/ETFs, which are low-cost in nature and well diversified – probably the right instruments for this type of offering.

Retirement planner

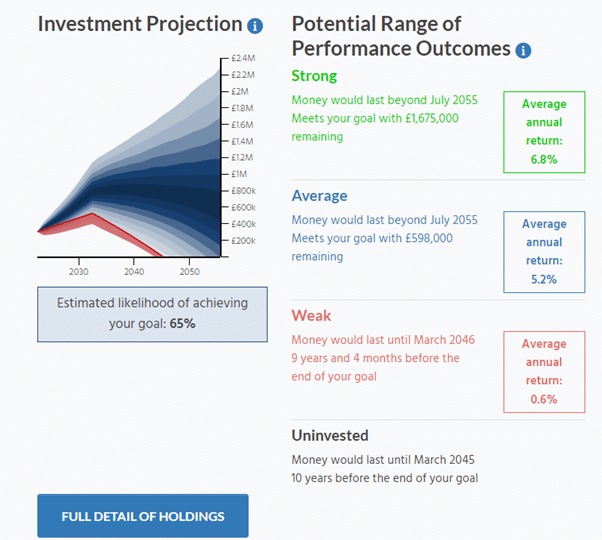

I had a quick play on the Netwealth retirement planner and, although it hasn’t broken any new ground, it is a useful tool that helps you understand the likelihood of hitting your financial goals.

However, it does suffer from the scourge of many retirement planners – crazy spread of outcomes, in this case between £0 and £2.2m is unhelpful. But the retirement planner is reasonably clear and useable, if very busy.

Finally, there is a slightly odd charging model that means that once you’re signed up, you can invite your friends & family and benefit from additional discounts. It seems to be trying to address what is perhaps the biggest problem for Netwealth — a minimum investment of £50,000. Once you put £50,000 into an account, others in your network can invest from as little as £5,000, but even that’s a reasonably high hurdle for younger members of a family.

I get that they’re aiming to offer a modern alternative to traditional wealth management, which is expensive, but these minimum investments can turn away many people who might otherwise love the Netwealth service.

Likes

- Investment performance since inception has been consistently good

- Access to professional advisers

- Onsite webinars are really good

- Calibre of management is very strong (no spotty start-up kids here)

- Should have a broader appeal, but for its oppressive user interface

- Works for charities, trusts and corporates

- Available in three currencies: GBP, EUR and USD.

Dislikes

- Quite expensive if it’s viewed as a DIY service, but very reasonable compared to a traditional wealth manager

- Minimum investment is pretty high

- Really word-heavy site with huge detail, that could be lightened considerably with graphics and design

- Not sure if the ‘Network’ really works for many people and the discounts are attractive but out of reach for solo investors. Feels like another awkward hurdle

- Hard to see what you’re actually buying before you actually register

- Potentially narrow appeal (and that’s a shame).

Conclusion

Netwealth is a really strong and appealing service that has been heavily camouflaged by an outdated user interface that makes every page look like hard work. There are lots of little details that make this a very attractive offering for people who want to set up a smart investment strategy from the start and leave it to the experts to keep it on track. As it’s an online discretionary manager, it’s included in our robo calculator. To see how it measures up against others, click here.

There are lower cost services in the market, but it depends on what you want. If you’re after a modern wealth management service, Netwealth is relatively cheap, whereas if you’re going to use it as your DIY or robo platform, then pricing is a little punchy. Visit our Netwealth page here or go directly to Netwealth.

Image by Marcus Spiske on Unsplash.