Chances are you already know what investing is, but just in case, we’ll tell you what investing is and then explain how you can do it.

What is investing?

Here’s a quick dictionary definition from Oxford: investing is to put (money) into financial schemes, shares, property, or a commercial venture with the expectation of achieving a profit.

No matter where you put your money, you’re essentially entrusting it to an entity such as a company or government with the expectation of receiving more money in the future. People usually invest money with a specific goal in mind such as retirement, education, or buying a home.

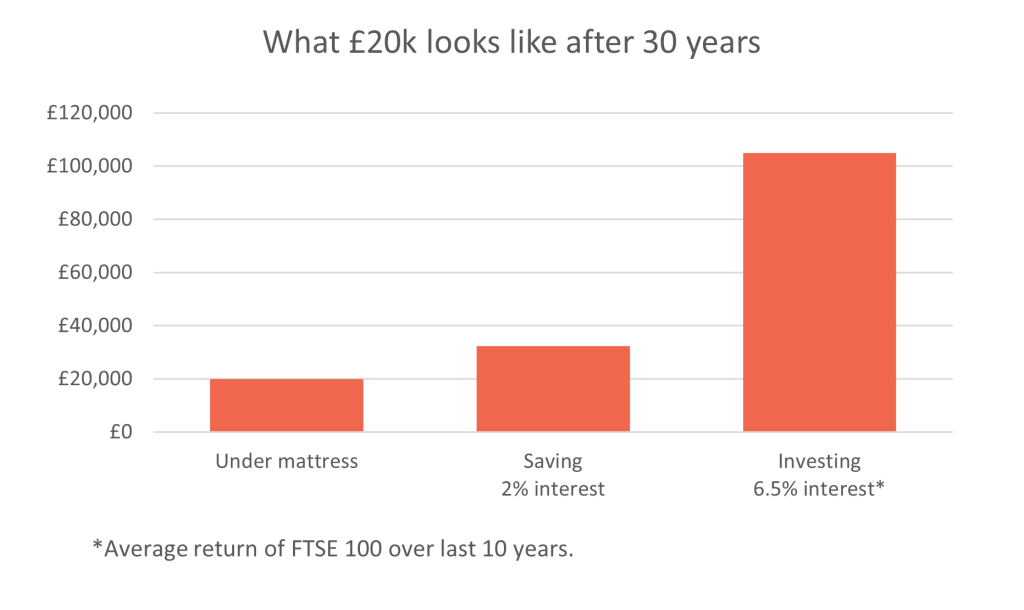

Investing is different from saving or trading. Generally investing is associated with putting money away for a long period of time rather than trading stocks on a more regular basis. Investing is riskier than saving money. Savings are sometimes guaranteed but investments are not. If you were to keep your money under the mattress and not invest — you’d never have more money than what you’ve put away yourself.

That’s why many people choose to invest their money. There are many things you can put money into. Here are just a few of those things.

Types of Investments

- Stocks

- Bonds

- ETFs

- Investment/mutual funds

- Investment trusts

- Property

- REITs

- Commodities

Link to guide on investments.

Things to consider before investing

Before diving into investing, it’s important to find out if you’re financially ready. Here are the basics to consider before taking the leap into investing:

- Do you have a lot of credit card debt?

If the answer is yes, it may not be the right time to start investing. Your priority should be to pay off any outstanding debts as soon as possible. The interest rates on credit cards are often much higher than what you could earn through investing, so it’s important to focus on eliminating your debt first.

- Do you have an emergency fund?

Shit happens. Unexpected events such as losing your job, a pandemic like Covid-19, and illnesses can disrupt your life. You should have at least 1 to 3 months’ worth of living expenses set aside in cash or savings.

Investing tips for beginners

Investing is what happens when you’ve paid the bills and put cash aside and you’ve got a few pounds left over to invest in your future. So how do you make sure that you’ve got those spare pounds at the end of the month?

Avoid lifestyle creep

You’re probably going to earn more in your thirties than you did in your twenties, and even more in your forties. To save consistently save money, you need to avoid lifestyle creep. Lifestyle creep is when you earn more money, what you used to consider as luxuries become part of your everyday life. Eating out every day or taking cabs to get you around town may be affordable, but they’ll eat into your bank balance. Instead you should try to live the way you always lived and put the extra money in the bank instead of increasing your spending. Skip eating out and the cabs every day and you can invest the extra cash in your bank account.

A little at a time

Once you’ve got some cash saved, you’ll want to invest. That’s because Inflation will almost always outpace the interest rate that you’ll be able to get on a savings account. (At the time of writing, the inflation rate was 10.5% while interest rates are an average of 2%). You’ll effectively be saving and losing money at the same time, so that’s why you should invest as soon as possible, even if you’re not a seasoned investor like Warren Buffet.

If you’re having difficulty setting aside money to invest, consider using an automatic savings app that rounds up your money to the nearest pound such as Plum or Chase. Investing small amounts of money is a great habit to get into and your money will grow over time with the benefit of compound interest.

Know what you’re investing for

How you invest depends on what exactly you’re investing for. You might be investing to buy a property in 5 years’ time or putting money aside for your retirement in 30. The time horizons are different and you should invest conservatively with shorter time horizons or even consider sticking to cash. However, if you’re investing money that you won’t need for a long time, you can take more risk.

Understand your risk tolerance

It is important to evaluate your personal risk tolerance before making any investment decisions. This essentially refers to the amount of money that you can afford to lose without significant consequences. For instance, if you require funds for immediate expenses like rent, your risk tolerance is low. Conversely, if losing the investment would have no substantial impact on your life, then your risk tolerance is high. Your risk tolerance is often determined by your ‘time horizon,’ which simply refers to the length of time you plan to hold a particular investment.

Savings accounts are generally considered to be low-risk and are best used for holding emergency funds, rainy day money, or rent money for the current month. On the other hand, investing is more suitable for money that you won’t need in the short term, such as your retirement savings or a fund for your child’s university education.

Diversify your investments

Rather than zero-in on some stock you think will perform well, diversify your investments. Diversifying your portfolio means investing in different geographies, industry sectors and types of securities. The best way to do this is to choose collective investments like funds, ETFs and robo-advisers or digital investment apps.

Markets will fluctuate in the short to mid-term and how you react could potentially be a bigger risk than short-term market movements. If all this portfolio diversification talk sounds like hard work — that’s because it is. Individual stock-picking rarely works so investing in well-diversified funds or through automated investing is a great alternative.

Invest for the long term

If you can put money away for a long time period, then you can afford to have investments that are typically more susceptible to rising and falling. Your portfolio can contain a mix of stocks and equities that are typically more volatile compared to bonds.

Watch out for high fees

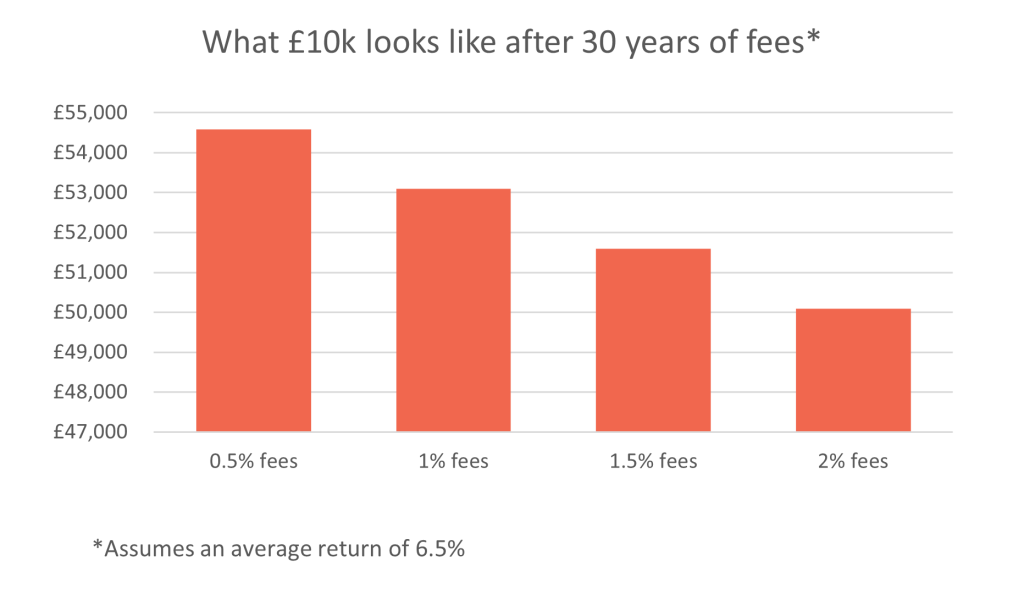

Regardless of how you invest, you’re going to pay fees and fees are the money you put into someone’s pocket rather than your own. What you need to watch out for is high fees as they’ll have a significant impact on your investment returns. You need to consider the value you’re getting in exchange for paying fees. Here’s how fees can affect your investment returns on an initial £10k for thirty years (assumes a return of 6.5%).

The last thing you want to do is overpay fees. If you are paying 1-2% in fees, you could lose up to 40% of your expected investment returns over time.

Photo by Nataliya Vaitkevich on Pexels