Understanding LISA interest rates: a comprehensive guide

Understanding LISA interest rates is crucial for individuals looking to make informed d...

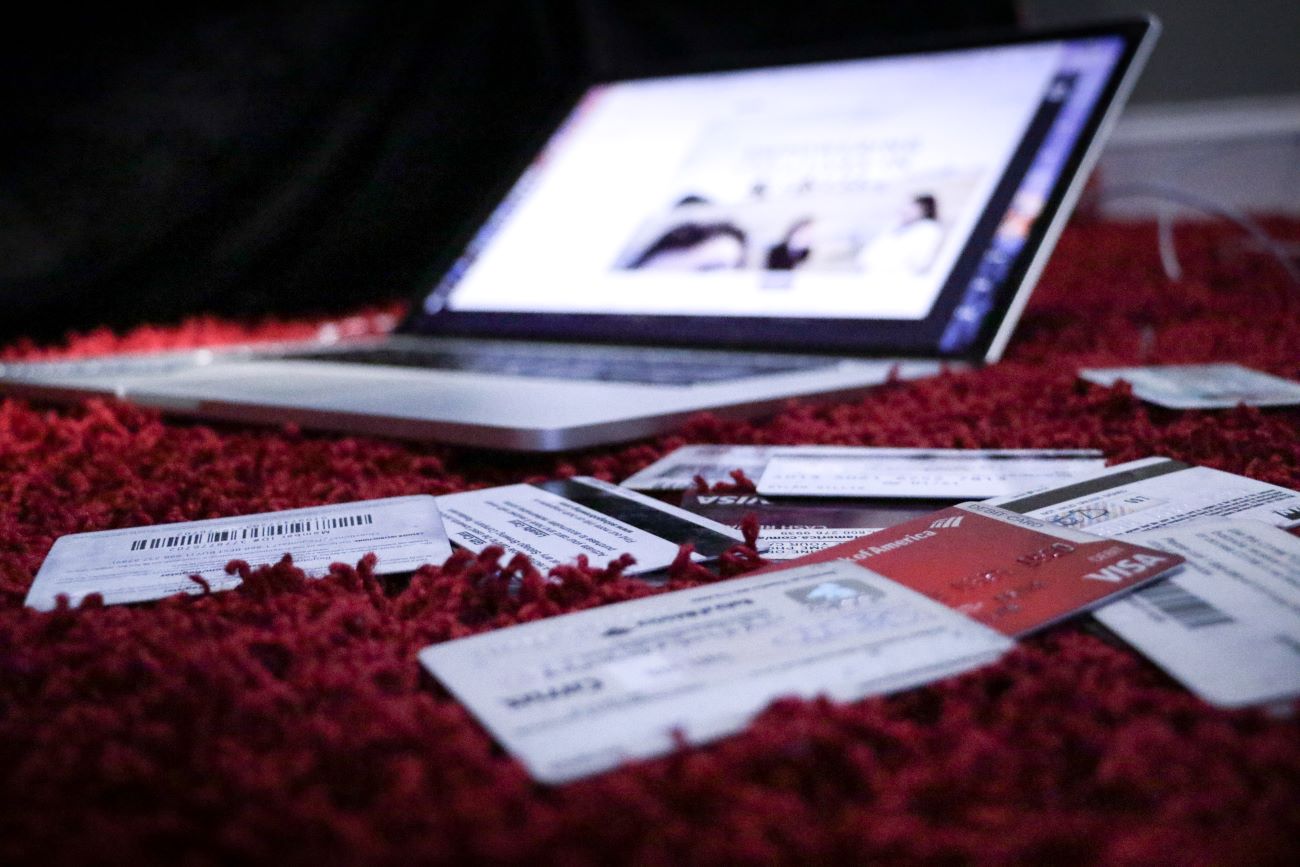

People are often tempted to invest even though they have personal loans and credit cards. That’s never a good idea because the money you might make on your investments is very unlikely to grow as fast as your debts – that’s because of a thing called compound interest.

Long before working out how much to invest regularly or what to invest in — you should pay off all bad debt. The key thing to realise is not all debt is bad and you should only focus on paying off bad debt. Examples of good debt are familiar to most people — mortgages that allow you to make a property purchase that you could never afford otherwise, or student loans that are not repayable until you earn over a certain amount.

Bad debts are just as familiar, they are referred to as bad debt as the interest is higher —in some cases multiple times higher — than you would pay on a mortgage. Examples include credit cards or short-term loans and the dreaded pay-day loans.

If you prefer to see some real-world examples to illustrate the difference, they are easy to find:

That means, comparing these two examples, the rate of interest you pay for the pay day loan is almost 50 times more. However, the difference isn’t always immediately obvious. It’s not always clear that loans have high interest rates because they’re often marketed with examples of how much you would repay each week — rather than each year — which is a much smaller amount and sounds easier to deal with. However, the detail and true rate is always there, so keep an eye out for the small print at the bottom.

The reason for highlighting the difference between good and bad debt is simple. There’s no point trying to make your money work harder for you if you have expensive debt. That’s because the interest you owe on debt will accumulate faster than the interest earned on your savings or returns on investments. The first thing to do is to tackle your debt and put in place a clear and consistent plan for clearing it.

The debt snowball method is a debt reduction strategy where you pay off debt in order of the smallest to the largest, gaining momentum as you wipe out each balance. When the smallest debt is paid in full, you roll the money you were paying on that debt into the next smallest balance. And so on. It works because you make progress quicker and wiping out each balance gives you a huge sense of satisfaction. Here’s how to do it:

1 List your debts from smallest to largest regardless of interest rate.

2 Make minimum payments on all your debts except the smallest.

3 Pay as much as possible on your smallest debt.

4 Repeat until each debt is paid in full.

Visit Compare+Invest for further guides to savings and investments.

Read the second and third blog in the ‘How to get investment fit’ series.

*Based on a 25 year, variable rate, repayment mortgage with 25% deposit and £150k mortgage

Photo by Benjamin Lehman on Unsplash

Photo by Dylan Gillis on Unsplash