Understanding LISA interest rates: a comprehensive guide

Understanding LISA interest rates is crucial for individuals looking to make informed d...

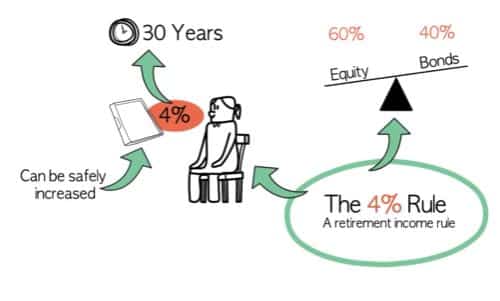

The 4% rule is a retirement income rule. The theory goes that if you take no more than 4% of your portfolio as income then it will last at least 30 years. The origins of this rule are based on equity and bond returns in a 60% equity 40% bond portfolio. The income doesn’t have to stay static; the amount taken can safely be increased by inflation ie index-linked.

The 4% rule.

The 4% rule is a retirement income rule.

The theory goes that if you take no more than 4% of your portfolio as income then it will last at least 30 years. The origins of this rule are based on equity and bond returns in a 60% equity 40% bond portfolio. The income doesn’t have to stay static, the amount taken can safely be increased by inflation i.e. index-linked.

The 4% rule has worked well for advisers in their clients but is now considered too simple and advisers use cash flow models and blend income from different sources to prevent depletion.

The safe 4% rate could reduce if interest rates stay as low as they have since the global financial crisis causing bond returns to also stay low.

Some people will continue to work or maybe receive windfalls, so sticking to 4% may see them experience an unnecessarily frugal retirement. The downside is that those having a one-off splurge especially early on in retirement can ravage the portfolio to the point where it cannot recover.

It’s a bit like plants being hit by a late frost, they never recover no matter how good the summer.