Understanding LISA interest rates: a comprehensive guide

Understanding LISA interest rates is crucial for individuals looking to make informed d...

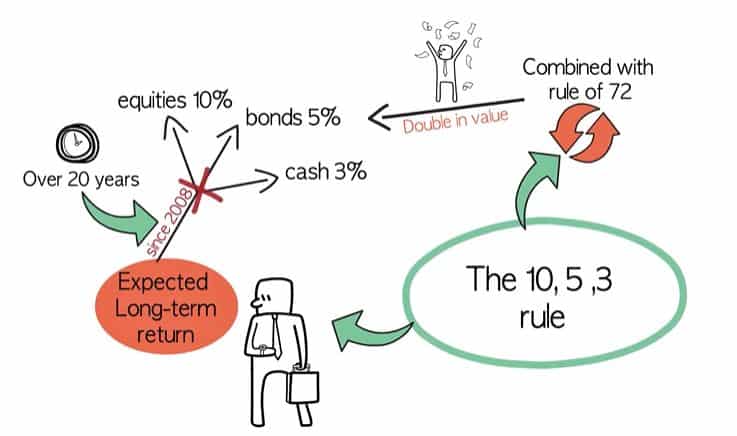

This is the expected long-term return from equities, bonds and cash. It can be combined with the rule of 72 so you can see how long it takes for each asset class to approximately double in value.

The 10, 5, 3 rule.

This is the expected long-term return from equities 10%, bonds 5%, and cash 3%.

It hasn’t quite worked out like that since 2008, but it’s a long term view over 20 years.

It can be combined with the rule of 72, so we can see how long it takes for each asset class to approximately double in value.

Equities: 72/10 = 7 years.

Bonds: 72/5 = 14 years.

Cash: 72/3 = 24 years.

If you have a target amount to achieve over 20 to 40 years, it shows why cash is probably not going to make it.

Equities are fastest and so should be able to reach higher targets but come with greater risk.

In the 10, 5, 3 rule, the real returns would be reduced by inflation.