Understanding LISA interest rates: a comprehensive guide

Understanding LISA interest rates is crucial for individuals looking to make informed d...

No one can predict the future but here is some advice to reduce your risk when picking stocks.

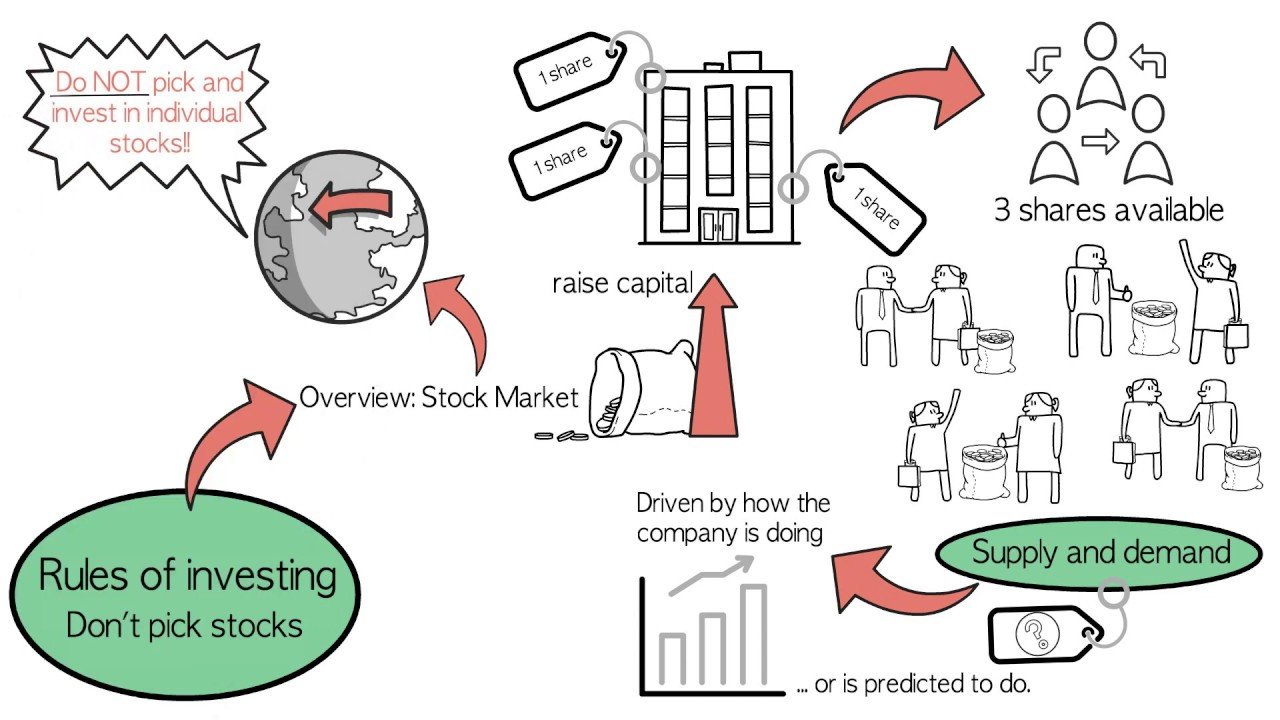

Rule Number 2: Do not pick and invest in individual stocks!

Watch the next simple investment rule here.

The second rule of investing: don’t pick stocks first.

Here’s a quick overview of the stock market. To raise capital money companies sell shares of their company on the stock market. These shares are publicly traded and there is a fixed number available. If someone wants to buy a share, someone else who owns a share must be selling it. It’s this supply and demand that determines the price of the company’s shares, usually driven by how the company is doing or predicted to do.

Now that we are all on the same page, let’s get down to the nitty-gritty of why the best investors in the world all say the same thing – do not pick and invest in individual stocks.

In 2012 The Observer newspaper pitted professionals Justina Quart student of seven investment management, Paul Kavanaugh of Killa kinko and Shraddha’s fund manager Andy brough against students from John Warner school in Hoddesdon Hertfordshire and Orlando a ginger cat which selected stocks by throwing his favourite toy mouse on a grid of numbers allocated to different companies. Orlando, one human cannot predict the future. Picking stocks is hard. Noone has a crystal ball to predict which company shares will go through the roof and which will tank. If there was a simple way to reliably predict which shares would outperform the rest, then every stock picker in every corner of the country would be a billionaire made by the stock market. There are legions more going broke.

You’re probably wondering why people invest if the stock market is so risky and unpredictable? That’s because the best way to invest is through an investment fund that buys and shares in lots of companies on behalf of its investors. The fund will protect you from some of the risk of picking the wrong stocks.

In investments, some stocks will go up and some will go down. There are two types of funds. Active fund, where the manager uses research knowledge and experience to decide which stocks to buy. There is also the index tracker. An index tracker buys the stocks inert index as a bundle – The footsie 100.

Although there is some risk, the stock market as a whole has always gone up over the long term. This means that if your portfolio investments reflect the broader stock market, your investment will grow over a long period of time even if some individual stocks go down.