Investing for the first time can be daunting, but here are five simple investment rules to get you started.

Rule 1: Start right now

Start right now, even if it’s just a £1 a day or a week. No matter how small the amount, you’ll see your money grow quickly. That’s because of a really simple but important concept – compound interest. Another way of explaining compound interest is that you get interest on the interest you get paid, and then you get paid interest on that interest, and pretty soon the interest you earned is bigger than the money you put in there in the first place.

Let say’s you put £100 in the bank. If the interest rate is 5% you’ll earn £5 in interest in the first year. That means you now have £105 instead of £100. The next time you receive interest, it will be on your original £100 as well as the interest you received, so £5.25. Now you have £110.25. And it will keep growing and eventually the interest bit will be bigger than the original sum you put in the bank. If you did that for 25 years (at the same rate interest rate) your £100 would become £338.64.

Now imagine that you saved £100 a year at the same interest rate. After 25 years, you’ll have saved £2500 but earned an additional £2273 in interest — almost double the amount you saved. It’s a bit like a snowball that rolls downhill, gathering snow. By the time it reaches the bottom, the snowball is much larger than it was at the start. That’s how compound interest works, it builds on itself.

The longer you save, the better. After 35 years of saving £100 a year, you would have accumulated £9032 and £5532 would have been interest.

Rule 2: Don’t pick stocks

First, here’s a quick overview of the stock market. To raise capital (money), companies sell shares of their company on the stock market. These shares are publicly traded and there is a fixed number available. If someone wants to buy a share, someone else who owns a share must be selling it. It’s this supply and demand that determines the price of a company’s shares, usually driven by how the company is doing (or predicted to do). Now that we are all on the same page, let’s get down to the nitty-gritty of why the best investors in the world all say the same thing — do NOT pick and invest in individual stocks!

The Cat’s Whiskers

In 2012, the Observer newspaper pitted professionals Justin Urquhart Stewart of Seven Investment Management, Paul Kavanagh of Killick & Co, and Schroders fund manager Andy Brough against students from John Warner School in Hoddesdon, Hertfordshire – and Orlando, a ginger cat, which selected stocks by throwing his favourite toy mouse on a grid of numbers allocated to different companies. Orlando won (more on the experiment here).

Humans cannot predict the future.

Picking stocks is hard.

No one has a crystal ball to predict which company’s shares will go through the roof and which will tank. If there was a simple way to reliably predict which shares would outperform the rest, then every stock-picker in every corner of the country would be a billionaire! For every billionaire made by the stock market, there are legions more going broke.

You’re probably wondering why people invest if the stock market is so risky and unpredictable? That’s because the best way to invest is through an investment fund that buys shares in lots of companies on behalf of its investors. The fund will protect you from some of the risk of picking the wrong stocks. In investments, some stocks will go up and some will go down.

There are two types of funds: active fund where the manager uses research, knowledge and experience to decide which stocks to buy. There is also the index-tracker. An index tracker buys the stocks in an index as a bundle, for example, the FTSE 100.

Although there is some risk, the stock market as a whole has always gone up over the long term. This means that if your portfolio (investments) reflects the broader stock market, your investment will grow over a long period of time even as some individual stocks go down.

Rule 3: Keep costs low

Your investments could be doing very well, but if the cost of managing those investments is high, then it reduces the long-term returns. Active funds charge higher fees, then there’s the cost of a financial adviser (if you use one) and the investment platform fees where your investments are hosted. All those costs can add up and erode your earnings, so it pays to pay attention.

Let’s say your investment is making an average return of 2% a year. If your adviser, investment platform and fund are charging you 2% a year, then your returns are wiped out. It’s the opposite of compound interest, those fees can snowball out of control.

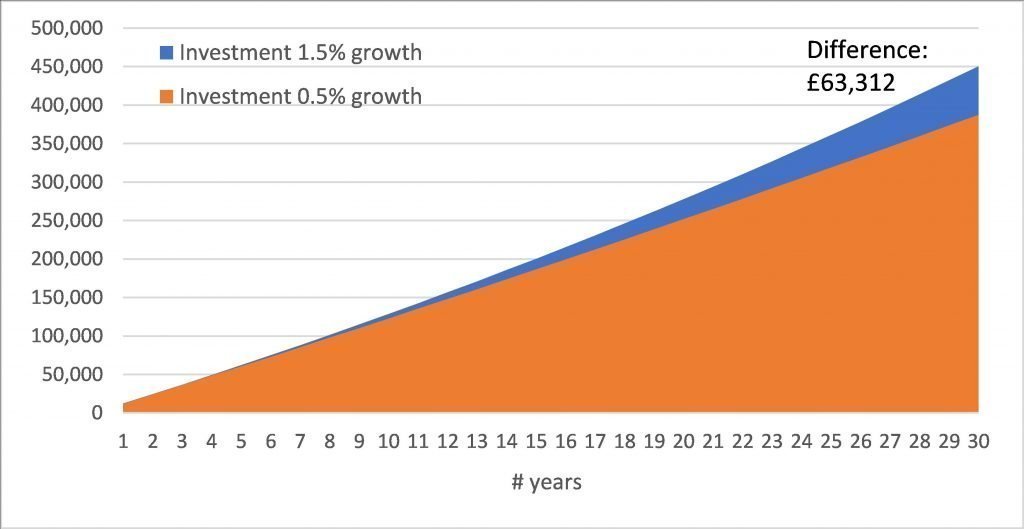

Let’s look at two people who invest £1,000 a month for 30 years. One is paying fees of 1.5% and one is paying fees of 0.5%. A 1% difference might not seem like a lot but after 30 years, the first person has accumulated a portfolio of £387,430 while the second one has accumulated a portfolio of £450,741. That’s a difference of £63,212, which is huge.

If you use an adviser, ask about the impact of fees on your investments. If you look after your own investments, check what you’re being charged for the platform and the fund charges.

Rule 4: Diversify

Investing in stocks and bonds comes with risk. It’s good to have a diversified portfolio which is the same as saying ‘don’t put all your eggs in one basket’. What if you’d put all your money into Blockbusters? In rule three we explained why stock-picking never works and why funds do. Smart investors spread the risk by buying funds that give exposure to different markets and asset classes.

If you spread your investments across lots of different industries such as pharmaceutical, industrial, internet, green energy etc across lots of different countries, it will protect you against any ups and downs in any part of your portfolio.

We human beings prefer to invest in what we know and trust, but rather than investing in a bunch of UK equity funds which will be invested in the same underlying investments, you can diversify with investments in UK, Europe, US and Asia-Pacific equity funds for example, spreading the risk and taking advantage of different economic factors in each of those markets. You should also diversify with cash, bond and mixed asset funds.

Rule 5: Tune out the noise

Emotion is the enemy of investment and when the markets are up and down it’s easy to get emotional. History has shown that trying to time the market usually leads to worse returns. Don’t listen to commentators telling you to buy or sell, have the conviction to stick to your long-term plan.

Investors who chase performance or who run away from poor performance are doomed. The difference between good and bad investors is that good investors can tune out the noise.

You’re bound to say that the 2008 global financial crisis was hardly just noise (or the recession that the coronavirus epidemic that we’re living through right now will probably lead to). And you’re right, situations like that can have a huge impact on investors and affect the economy for years.

But the people who panicked and pulled out in 2008 to protect their money crystallised their losses and then lost out on the next 10 years of stellar growth. The stock market has risen by 84% in that time – that’s a lot to lose out on. Smart investors stay invested. And we know you’re smart investors.

Photo by Paul Hanaoka on Unsplash