Understanding LISA interest rates: a comprehensive guide

Understanding LISA interest rates is crucial for individuals looking to make informed d...

Platforms have come under the spotlight this week after the City watchdog has blasted fund platforms for making it ‘complex and time consuming’ for investors to switch between them. After a year-long investigation the Financial Conduct Authority (FCA) has concluded that ‘barriers to switching are significant’.

Those reading this will already know that there is a perfectly good way to compare the costs of running investments — right here on this very website! But one clear problem when it comes to making the switch from an existing platform is that many platforms charge an exit fee, which can deter people from moving to better value firms.

Charges to switch range from £25 + VAT to an eye-watering £400 +VAT depending on the platform and the kind of investment you are moving — an ISA, SIPP or general investment account. Larger penalties are applied if you want to switch if the account has been open for less than a year. And even larger charges are made to those moving money overseas.

The FCA could move to ban these fees, but not until early next year when it reveals its final decisions on how to improve the market for private investors. The good news is that some platforms will cover any exit penalties to win new business. AJ Bell YouInvest, Barclays and Bestinvest will cover up to £500 of exit fees when you transfer to them. When you transfer to Selftrade they will refund any fees you may be charged up to a total of £100 per new account. Fundsnet will pay a £25 reward for each account you transfer with no strings attached.

The FCA found further problems, however. There are hundreds of thousands of so-called orphan clients — those who were signed up to a platform by their financial adviser, with whom they no long have any relationship. The FCA highlighted that these investors (an estimated 400,000) had limited ability to access and alter their investments on an adviser platform, so are effectively paying for functionality they cannot use. Investors in this situation should quickly take steps to find another adviser through organisations like unbiased.co.uk or vouchedfor.co.uk.

The watchdog also said that customers who use so-called ‘model portfolios’ on offer could be taking on more risk than they anticipated. Investors with large cash balances were also an area of concern for the FCA. It said they may not be aware of the platform fees they’re paying and that they are missing out on potential investment returns.

The FCA investigation was launched last year amid concerns that investors were not getting the best value for money and that big providers were keeping out competition from cheaper rivals. The regulator is arguably right to look more closely at the industry. It’s big business to say the least. Nearly 80% of retail investments are made through platform providers and the investment platform market has almost doubled in size since 2013 — it now has £500bn of assets under management. During the same period, an extra 2.2 million customer accounts were opened.

The good news is that, in the main, the FCA claimed that competition in this arena is working well for savers. It’s seeking feedback on its initial findings and proposed remedies before publishing its final conclusions about the market in early 2019.

Until then, the main take-away is not to let complacency get the better of you and your savings. Ensure you are getting the best value from your platform — even if you have to pay an exit fee, it may still be worth your while. Especially if you can get your new platform to cover the costs for you.

—

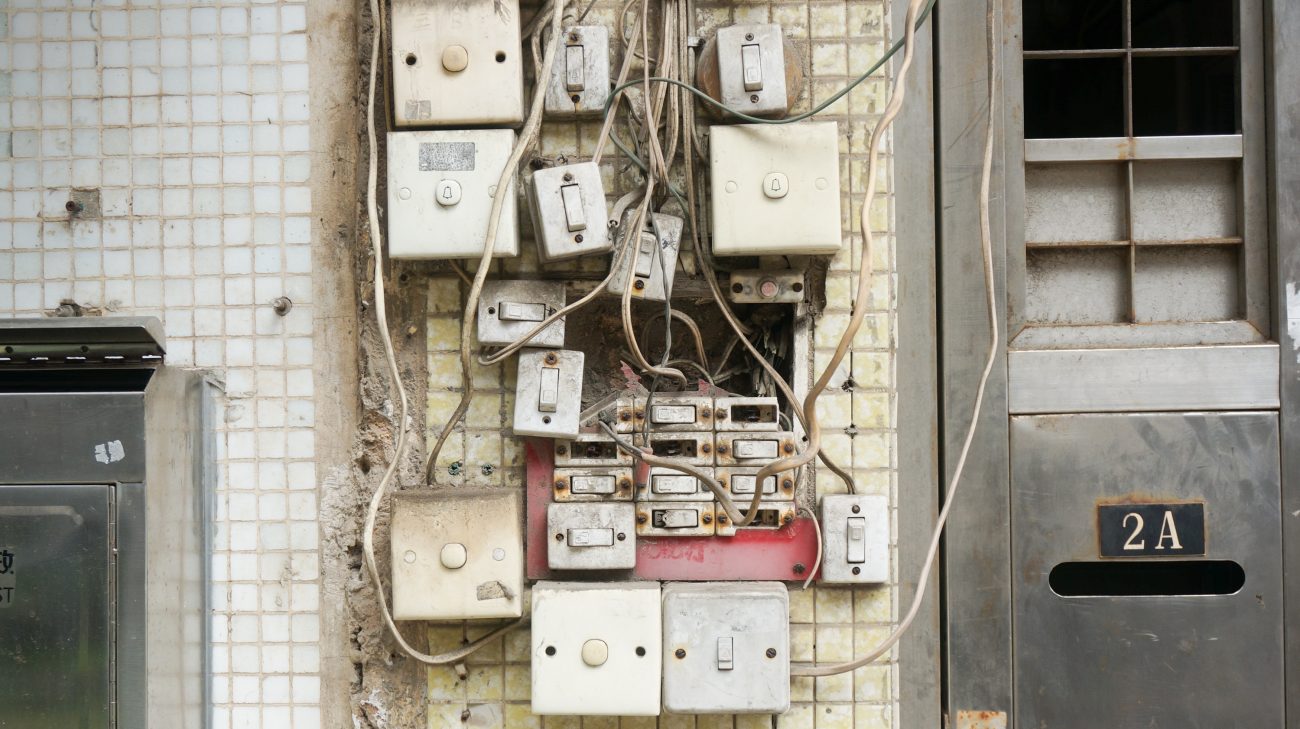

Switch photo by Yung Chang on Unsplash

Arcade photo by Carl Raw on Unsplash