After trailing it for three years, Vanguard has finally launched its long-awaited low-cost Sipp. Famous for its low-cost investment philosophy, the US investment giant launched its direct platform in 2017, but didn’t include a pension or drawdown facility in its range of products and wrappers. Until now.

With an account fee of just 0.15% (15p for every £100) capped at £375 per year, Vanguard is giving other DIY platforms a good run for their money. What’s more, a pension can be opened with just £100 a month or a lump sum of £500. Compare this to Hargreaves Lansdown, the largest DIY platform in the UK, which charges up to 0.45% and it’s easy to see why the industry and the media are all up stirred up.

Now for the detail…

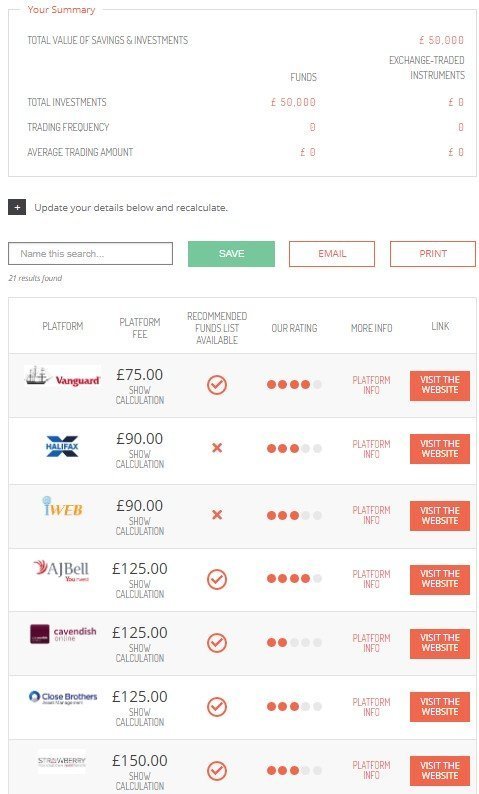

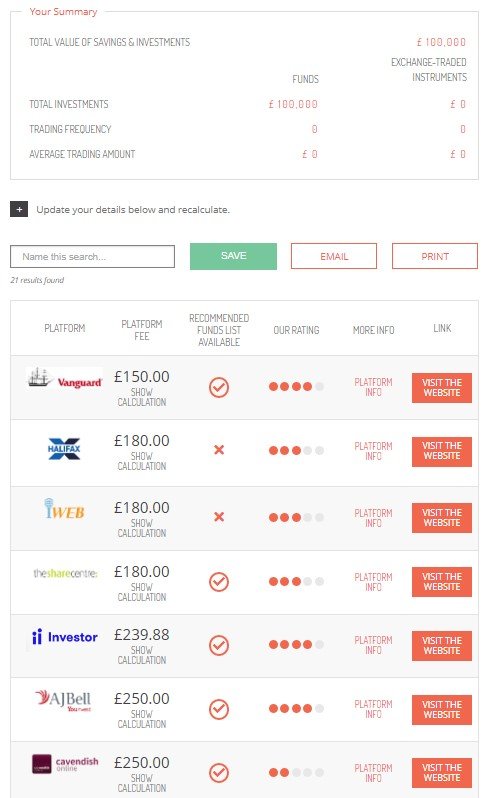

We ran different sized pension pots through our platform calculator to see how Vanguard stacked up against the competition. For pension pots of £50k and £100k, Vanguard is the cheapest pension in the market, cheaper even than Halifax and iWeb, the market’s no-frills platforms.

Large platforms like AJBell, Fidelity and Interactive Investor are not too far behind, but with Hargreaves Lansdown charging three times as much as Vanguard, it ranks 21st for the £50k portfolio and 14th for the £100k portfolio.

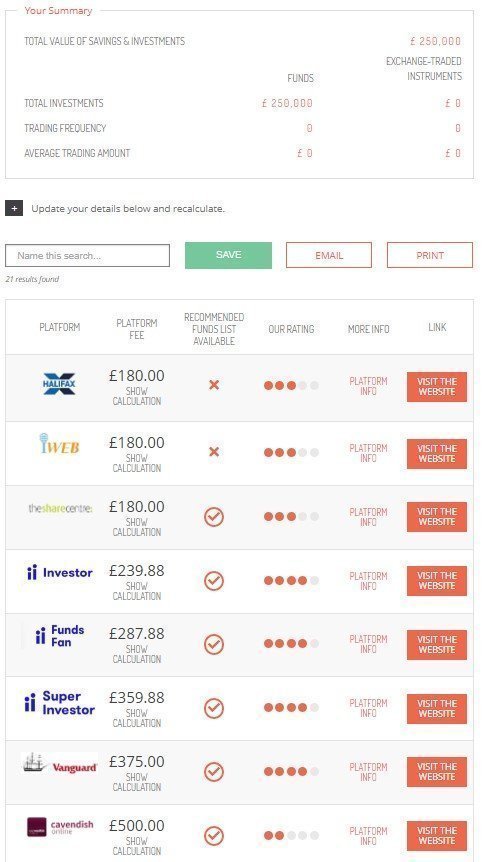

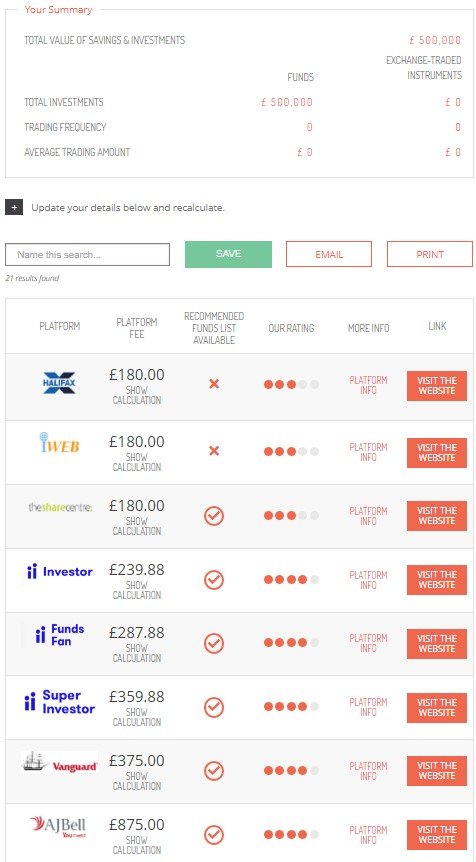

Things to start look interesting when we get into higher price brackets. The Vanguard Sipp slips below The Share Centre and Interactive Investor. Interestingly, Interactive Investor has just agreed to acquire The Share Centre so its investors are likely to move to flat fees as customers from previous acquisitions have done.

Interactive Investor had previously acquired TDDirect and Alliance Trust and is now big enough to compete with the likes of Hargreaves, Barclays Smart Investor and Fidelity Personal Investing.

Price isn’t everything

Of course, cheapest doesn’t mean best and it’s worth noting that the fees above do not include fund charges which will also have an impact on your overall portfolio. The Vanguard site is well designed, easy and intuitive to use, but you can only invest in Vanguard funds — there are currently 77 funds and ETFs to choose from, including the popular LifeStrategy fund range and its Target Retirement Fund range.

For context, Hargreaves Lansdown has several thousand investment options from many different fund managers. Everyone wants choice, but too much choice can be overwhelming so shorter lists are always a good idea. If you can live with Vanguard only funds, then the Vanguard Sipp is a good option.

If you have a relatively small pension or are thinking about starting one, then the Vanguard Sipp is a good option. Keeping costs down can make a significant difference to your portfolio over time, so the combination of a low-cost Sipp and low-cost funds is attractive.

Even in the higher price brackets, investors should weigh up platform/sipp costs together with fund charges before making a decision. Investors with larger, more complex pension arrangements may find a better fit elsewhere.