Understanding LISA interest rates: a comprehensive guide

Understanding LISA interest rates is crucial for individuals looking to make informed d...

As the Great British Bake Off has returned to our TV screens, we thought it would be a good time to update you on our Great British Wealth Off (GBWO) experiment which is now halfway through its second year.

But first, a little recap. The personal finance papers and websites are awash with stories on the pros and cons of passive and active investment, robo advice, fees and the like. It seems like every week there is a new right way to invest which is confusing and alarming for the investor — we’re not talking about cushions here! So we started the GBWO experiment in February 2017 with the aim of helping investors understand that there is no right and wrong way to invest.

We wanted to demonstrate that these (often polarised) claims and stories can give investors unrealistic expectations and make it difficult for them to make informed choices. Different investment solutions and advice paths can be as effective as each other, as well as showing them that those investments will naturally ebb and flow depending on market conditions. Investors must also understand that investment is for the long term.

| Investments | Type | Value (£) Feb 2018 | Value (£) May 2018 | Value (£) Aug 2018 | Qtr Grth % | Overall Grth % | Risk profile |

|---|---|---|---|---|---|---|---|

| RL Sustainable World, direct | Act | 351.45 | 344.16 | 374.70 | 8.9 | 24.9 | 4 |

| RL Sustainable World, DIY plat | Act | 351.42 | 344.13 | 374.61 | 8.9 | 24.9 | 4 |

| RL Sustainable World, adviser | Act | 348.96 | 341.73 | 370.68 | 8.5 | 23.6 | 4 |

| Active portfolio, DIY plat | Act | 333.81 | 326.91 | 344.91 | 5.5 | 15.0 | 4 |

| Active portfolio, direct | Act | 332.7 | 325.83 | 343.23 | 5.3 | 14.4 | 4 |

| Vanguard LifeStrat 80% Eq, direct | Pass | 326.1 | 319.35 | 343.08 | 7.4 | 14.4 | 4 |

| Vanguard LifeStrat 80% Eq, DIY plat | Pass | 325.26 | 318.54 | 341.79 | 7.3 | 13.9 | 4 |

| Active portfolio, adviser | Act | 331.47 | 324.63 | 341.28 | 5.1 | 13.8 | 4 |

| Architas MA Active Prog, DIY plat | Act | 328.83 | 322.05 | 339.9 | 5.5 | 13.3 | 4 |

| Vanguard LifeStrat 80% Eq, adviser | Pass | 322.98 | 316.32 | 338.19 | 6.9 | 12.7 | 4 |

| Architas MA Active Prog, direct | Act | 327.45 | 320.67 | 337.62 | 5.3 | 12.5 | 4 |

| Architas MA Active Prog, adviser | Act | 326.55 | 319.77 | 336.36 | 5.2 | 12.1 | 4 |

| Passive portfolio, direct | Pass | 324.81 | 318.09 | 333.36 | 4.8 | 11.1 | 4 |

| Passive portfolio, DIY plat | Pass | 324.06 | 317.34 | 332.16 | 4.7 | 10.7 | 4 |

| Passive portfolio, adviser | Pass | 321.78 | 315.12 | 328.68 | 4.3 | 9.6 | 4 |

| Hawksmoor Vanbrugh, DIY plat | Act | 324.48 | 317.76 | 325.17 | 2.3 | 8.4 | 3 |

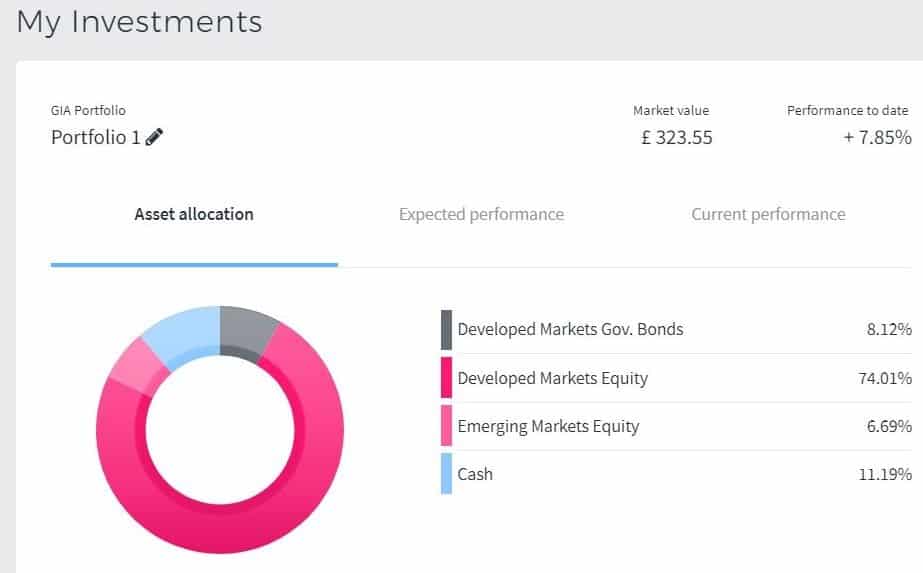

| Moneyfarm | Robo | 322.17 | 313.87 | 323.55 | 3.1 | 7.9 | 5 of 6 |

| Hawksmoor Vanbrugh, direct | Act | 322.89 | 316.2 | 322.77 | 2.1 | 7.6 | 3 |

| Hawksmoor Vanbrugh, adviser | Act | 322.2 | 315.54 | 321.78 | 2.0 | 7.3 | 3 |

Volatility has plagued the UK since the start of the year, resulting in the FTSE 100 and the FTSE All Share notching up less than 1% growth since the start of the year. Since February 2017, the two indices have risen by 6.7% and 7.6% respectively, so it would be natural to assume that our 19 investments should deliver at least 7% for the past 18 months. Thankfully they have done!

A volatile stock market is a great opportunity for good active fund managers to showcase their skills as highlighted by the active products in the top half of the table where the Royal London Sustainable World Trust continues to outperform its peers with a 24% increase to £375. However, at the other end of the scale, the Hawksmoor Vanbrugh investment has grown to just £322. Both funds are actively managed funds, but while Hawksmoor de-risked its funds some time ago and has an SRRI of 3, the RL Sustainable World Trust has only just seen its SRRI drop to 4.

Over five years the RL Sustainable World fund has achieved cumulative performance of 91%, outperforming its closest rival (Baillie Gifford) by a considerable 20%. It also tops the sector over one and three years. In addition, the fund is managed along sustainable environmental, social and governance (ESG) lines, which is an increasingly important criterion for investors. Bizarrely, despite its sterling credentials, it’s not on Hargreaves Lansdown’s Wealth 150 or Wealth 150+ lists. As Hargreaves Lansdown is the biggest D2C platform in the UK by a country mile, this fund would be selling like hot cakes if it were.

Among the passive cohort, the Vanguard LifeStrategy 80% performed well coming in third overall and ahead of the Architas fund. The fund has 80% exposure to equity and 20% to bond, most of which is achieved via its own passive index funds although it does occasionally make direct investments in shares and bonds. With an ongoing charge figure (OCF) of just 22% (excluding transaction costs), the LifeStrategy 80% fund is able to boost its returns considerably (note to all fund managers who are looking at boosting a fund’s returns, start with the costs).

Moneyfarm, the sole robo-adviser in the experiment, was second to last in the ranking with assets of £326. Although risk-rated 6 out of a possible 7 (proprietary rating system), the asset allocation is more conservative with around 11% in cash, while the charges are higher than other passive products. Moneyfarm investors with portfolios below £20,000 are charged 0.7% for the service and an average of 0.3% for the underlying ETFs so this will drag on performance compared to Vanguard’s very competitively priced product.

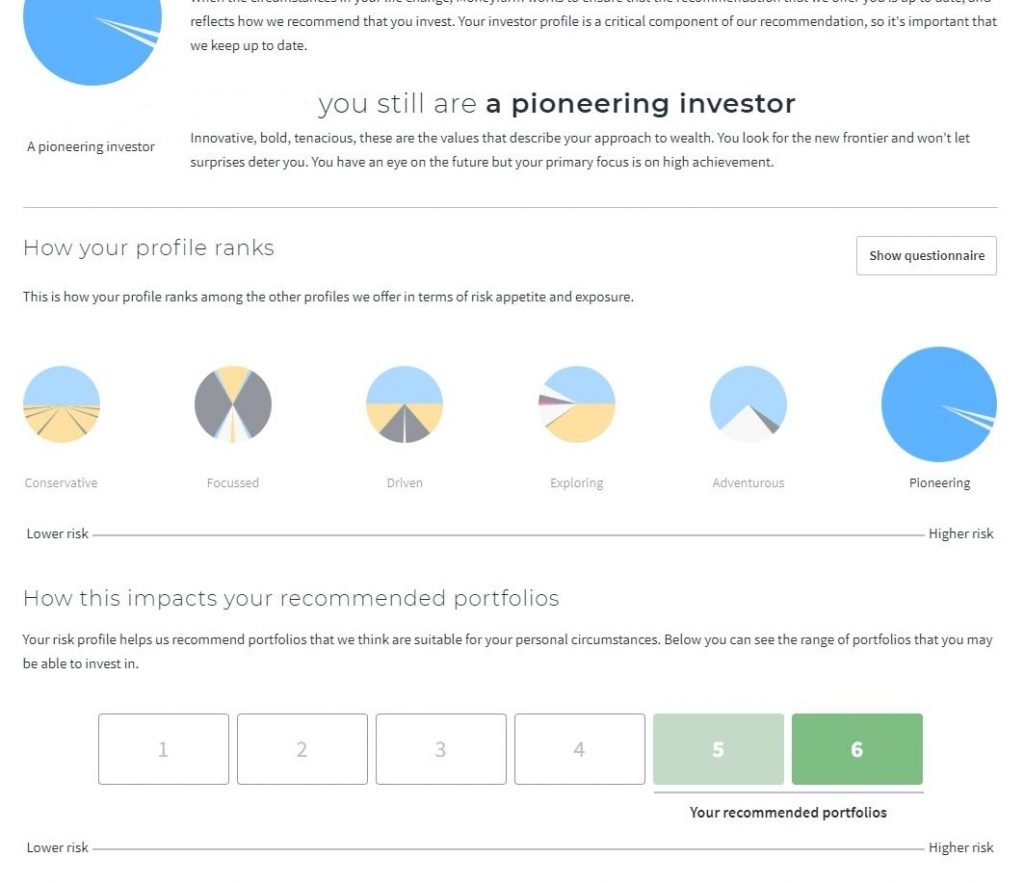

During the quarter, Moneyfarm re-balanced my portfolio and also re-assessed whether my circumstances had changed and my attitude to risk. The screenshot below demonstrates how my profile ranks (top) and Moneyfarm’s recommended portfolios for my personal circumstances. I am still in the fifth portfolio. The great thing about Moneyfarm is that you can review the questionnaire at any time and make changes as necessary.

The difference between the top and bottom investments, both of which are active, is considerable (16%). Now imagine the investment had been for £3,000 or £30,000 or £300,000 and you start to understand why this could have a significant impact in the long term. But as I said before, Hawksmoor de-risked before other investments in our experiment did and has a more cautious approach overall. A longer-term bear market could reverse the table completely. And given the current WH occupant and the utter chaos in government and its opposition, such a prospect is looking more likely by the day.

Tune in next quarter.

Photo by Brina Blum on Unsplash