Understanding LISA interest rates: a comprehensive guide

Understanding LISA interest rates is crucial for individuals looking to make informed d...

For the last few years, investors have been bombarded with articles and information about the best way to invest. They’ve been routinely told that active investments are a rip-off, passive is the only way to invest, robo is the future, yada yada yada. What’s worse is that many articles give a one-sided view, leaving investors bewildered and worried about their investment choices. We started the Great British Wealth Off (GBWO) to show consumers that investments are not binary, black or white, right or wrong decisions. If your neighbour has everything in passive funds and manages his money himself, that doesn’t mean his way is better, it just means that his way suits him.

Passive advocates, for example like to point out that that it’s difficult to outperform the index, and if managers do, their costs erode any performance gains. And yet they also fail to point out that when stock markets are in a bubble, index-trackers can aggravate the situation by continuing to buy the same shares, pushing up prices and enlarging the bubble.

Equally, active fund managers can come into their own (or at least they should) when markets are volatile. But not all of them perform well — the law of averages tells us that half of all active managers will be better, and half will be worse than average. So how do you make sure you pick from the top half? You can’t, and that’s the crux of the problem — and it’s why passive evangelists insist we shouldn’t bother.

However, we want consumers to understand that it’s about personal choice and what makes you feel comfortable. In this experiment, we invested in a range of active and passive investments in three different ways: through an adviser, direct with the fund manager, and on a DIY investment platform. It was designed to show people that there is sometimes very little difference between thesw options and those differences can change over time depending on market conditions and other factors.

People often ask if they should do it themselves, go through an adviser or use one of the many robo-advisers around. It really depends on the context and what your investment objectives are. Let’s take investing through an adviser — if you’re setting up your annual ISA you may decide you don’t need advice (especially if you’re comfortable picking your own funds), but when it comes to making sure your pension pot lasts you for 40 or so years, you won’t want to get it wrong (living off baked beans is not an appealing prospect when you’re 80) so financial planning and advice are critical in that scenario. Context is important.

But let’s get back to our experiment. The stock market was volatile between 2 November 17 and 2 February 2018, with the FTSE closing the month down by 1.5%. Only three of our investments grew during the three-month period — the Architas MA Active Progressive and the Hawksmoor Vanbrugh fund (in all three purchasing options) and Moneyfarm, the robo-adviser. In contrast, the worst performance came from the passive control portfolio.

We used the FTSE 100 as a loose benchmark for our investments because they have different geographical regions and exposures. It rose by 4.2% between 2 February 2017 to 2 February 2018, but it’s worth noting that the MSCI International Word index was up 15.6% over the same period. Despite negative growth in the last three months, the Royal London Sustaintable World trust is in the lead for the year. Overall, the active funds performed better than their passive counterparts this year, but next year it could be the other way round.

| Investments | Type | Value (£) Nov 17 | Value (£) Feb 2018 | 3-mth Grth % | Yr Grth % | Risk prof |

|---|---|---|---|---|---|---|

| RL Sustainable World, direct | Active | 354.27 | 351.45 | -0.80 | 17.15 | 5 |

| RL Sustainable World, DIY plat | Active | 354.24 | 351.42 | -0.80 | 17.14 | 5 |

| RL Sustainable World, adviser | Active | 352.38 | 348.96 | -0.97 | 16.32 | 5 |

| Active portfolio, DIY plat | Active | 335.91 | 333.81 | -0.63 | 11.27 | 5 |

| Active portfolio, direct | Active | 335.07 | 332.70 | -0.71 | 10.90 | 5 |

| Active portfolio, adviser | Active | 334.14 | 331.47 | -0.80 | 10.49 | 5 |

| Architas MA Active Prog, DIY plat | Active | 327.30 | 328.83 | 0.47 | 9.61 | 4 |

| Architas MA Active Prog, direct | Active | 326.13 | 327.45 | 0.40 | 9.15 | 4 |

| Architas MA Active Prog, adviser | Active | 325.53 | 326.55 | 0.31 | 8.85 | 4 |

| Vanguard LifeStrat 80% Eq, direct | Passive | 330.09 | 326.10 | -1.21 | 8.70 | 4 |

| Vanguard LifeStrat 80% Eq, DIY plat | Passive | 329.46 | 325.26 | -1.27 | 8.42 | 4 |

| Passive portfolio, direct | Passive | 329.10 | 324.81 | -1.30 | 8.27 | 5 |

| MI Hawksmoor Vanbrugh, DIY plat | Active | 323.28 | 324.48 | 0.37 | 8.16 | 3 |

| Passive portfolio, DIY plat | Passive | 328.50 | 324.06 | -1.35 | 8.02 | 5 |

| Vanguard LifeStrat 80% Eq, adviser | Passive | 327.72 | 322.98 | -1.45 | 7.66 | 4 |

| MI Hawksmoor Vanbrugh, direct | Active | 322.05 | 322.89 | 0.26 | 7.63 | 3 |

| MI Hawksmoor Vanbrugh, adviser | Active | 321.57 | 322.20 | 0.20 | 7.40 | 3 |

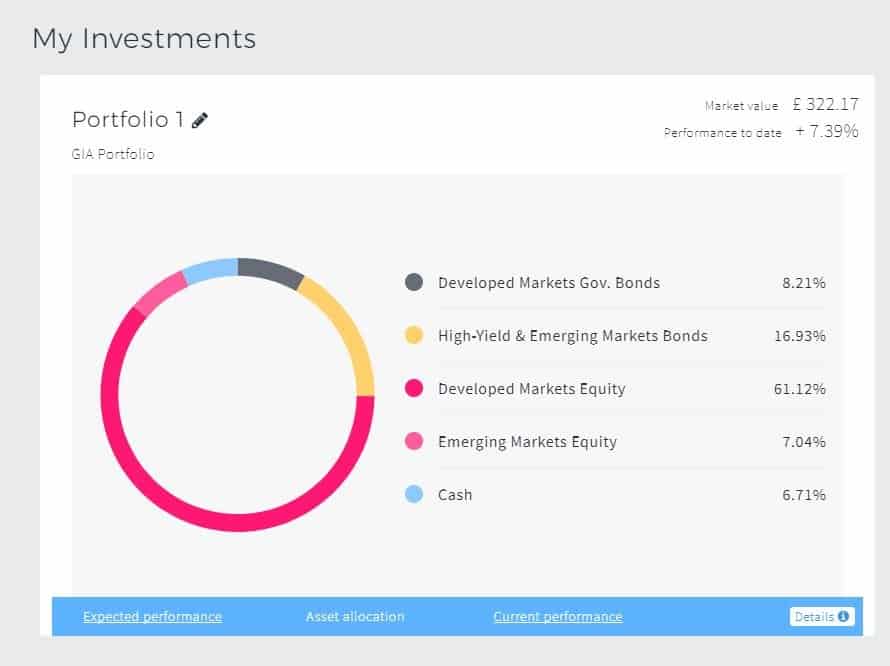

| Moneyfarm | Robo | 318.34 | 322.17 | 1.20 | 7.39 | 6* |

| Passive portfolio, adviser | Passive | 326.79 | 321.78 | -1.53 | 7.26 | 5 |

| *Moneyfarm profile 6 out of a possible 7 - Pioneering investor |

Of all the active products, the Hawksmoor Vanbrugh fund has performed less well over the year because of its changing risk profile. When we started this experiment, we chose funds that had the same risk profile (5) to make comparisons easier — as most DIY investors would have done — only to find that some of the funds have seen their risk profile change over the year. That’s because, contrary to what most investors believe, the risk profile is an ongoing calculation that changes depending on the fund’s volatility. Just how much it changes was a surprise, so I’m sure most consumers have no idea that the risk profile can be very misleading.

In the Vanbrugh fund’s case, the fund changed risk profile because Hawksmoor deliberately de-risks the portfolio in rising markets, which is part of its process of adapting to prevailing conditions. It is now risk profile 3. It is also in a different IA sector (Mixed 20-60% sector) whereas the other chosen investments are in the Mixed 40-85% sector.

But it’s even more complicated than that. We looked at different risk profilers’ ratings and found that the Synthetic Risk and Reward Indicator (SRRI) for the Vanbrugh fund was different when we downloaded it from different websites (YouInvest v Hargreaves Lansdown). Why? I have no idea but it’s obviously something that the regulator and the industry needs to tackle more rigorously. If I can’t make head nor tail of this with my bit of investment knowledge, what hope for ordinary consumers? The table below sets how our investments compare across different raters and sites.

| Fund | MStar Sector | IA Sector | Kiid SRRI Youinvest** | Kiid SRRI HL** | DT Risk Rating* | FE Risk Rating* | MStar SRRI* |

|---|---|---|---|---|---|---|---|

| Architas MA Active Prog | GBP Mod Adv Alloc | Mix 40-85% | 4 | 4 | 4 | 64 | 4 |

| Hawks. Vanbrugh | GBP Mod Alloc | Mix 20-60% | 4 | 3 | 2 | 33 | 3 |

| Vanguard LS 80% Eq | GBP Mod Adv Alloc | Mix 40-85% | 4 | 4 | 4 | 80 | 4 |

| RL Sustain World | GBP Mod Adv Alloc | Mix 40-85% | 5 | 5 | 5 | 87 | 5 |

| *07/12/2017 **12/12/2017 |

When we first started, we said we would run it for a year but there’s been overwhelming demand for us to continue in the long term. We’re going to continue our experiment for another couple of years. We’re in for a pretty volatile few years (US trade wars, Brexit, etc) which is likely to wreak havoc on our investments, but that shouldn’t matter too much because investments are for the long term and you should always expect a few bumps along the way.

Think you know which investment might win this experiment in February 2019? Send us your prediction for the investment that will top on 2nd February 2019 and we’ll enter the winning answers in a prize draw for a Kindle Fire*.

Tune in next quarter for the next update. To see earlier posts about the GBWO: February 2017, August 2017, November 2017.

*How to enter and terms & conditions: Email Compareandinvest with your full name and email and answer (only ONE of the 19 investments will be accepted) by Friday 9th March 2018. Late answers will be excluded. Only one entry per person. The first entry will be accepted. All subsequent entries will be disqualified. The draw will be made on Friday 1st March 2019.