Chancellor Rishi Sunak unveiled his Autumn Budget which he said was designed to prepare the UK for an ‘age of optimism’. Major tax hikes had already been announced in September, yet the Autumn Budget contained other new measures that affect our personal finances. Here’s the good, bad and the ugly of the Autumn Budget:

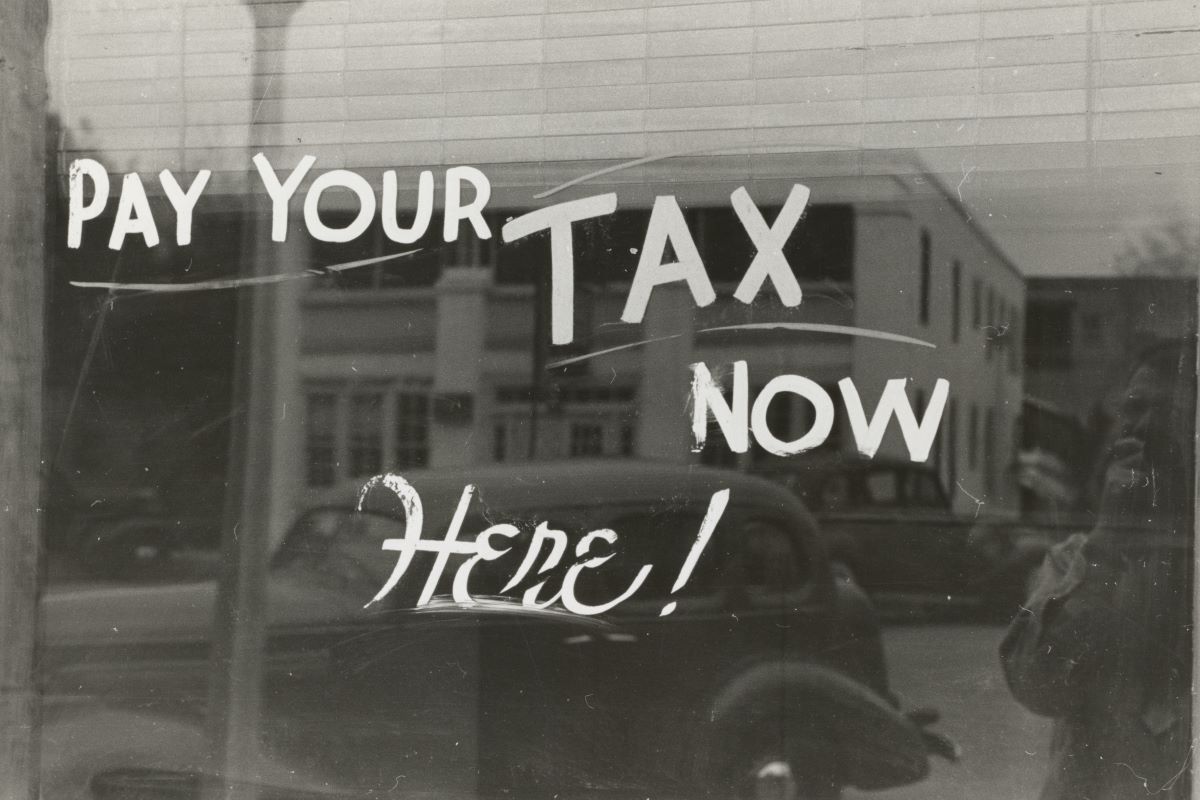

Taxes

Lower National Insurance thresholds included in the Budget would normally mean we pay less tax.

Yet the Budget also confirmed the increase in National Insurance by 1.25 percentage points from April 2022, which means that most taxpayers will be subject to higher NI from next year. The more you earn, the bigger an impact this will have.

The NI increase is not the only threat to income. By freezing the income tax thresholds until 2026 (announced in the March 2021 Budget) including the lower levels, people on more modest salaries will also be dragged into higher tax brackets and pay higher tax bills.

A major report by the Institute for Fiscal Studies (IFS) said that the combination of inflation and higher taxes would outweigh any wage increases for those on middle incomes. It warned that middle earners would be around £180 worse off next year compared to their present income.

While there was no change for the capital gains tax thresholds in Wednesday’s Budget, the Chancellor announced that there will be an increase in the payment window for capital gains tax purposes in relation to UK property disposals. The payment window of 30 days has now been extended to 60 days.

Inheritance Tax (IHT) thresholds were also unchanged in the Budget. The nil-rate band has been frozen at £325,000 since 2009/10, so IHT has been increasing in real terms over time. Had inflationary adjustments not been suspended, the nil-rate band would now be much higher at £417,000.

Savings and Investments

The annual ISA allowances were unchanged at £20,000 for the 2022/23 tax year and £9,000 for Junior ISAs meaning investors cannot shelter any more savings from tax.

The Budget also confirmed the rise to dividend taxes. Each investor can receive £2,000 in dividends a year without paying tax. Above that basic, higher and additional-rate taxpayers pay 7.5%, 32.5% and 38.1% respectively. These rates will rise by 1.25 percentage points in April 2022.

For basic rate taxpayers that means the rate will be 8.75%, and for higher-rate and additional-rate taxpayers it will climb to 33.75% and 39.35% respectively. This emphasises the importance of holding dividend-paying investments – where possible – in an ISA.

The launch of the Green Savings Bonds was highlighted in the Autumn Budget. They were made available to customers via NS&I on 22 October. The NS&I Green Savings Bond is a three-year fixed-term savings product with an interest rate of 0.65%. Customers can invest between £100 and £100,000. Backed by an HM Treasury-backed 100% guarantee, they will be on sale for a minimum of three months.

Pensions

The rate of pensions tax relief is often rumoured to be on the chopping block, but was left alone this week. There was no change to the pensions lifetime allowance which remains frozen at £1,073,100, however. The allowance has been dramatically cut over the last decade and is now frozen at £1,073,100 until 2026.

While this may appear high to most savers, it is leading to a growing number of workers risking breaching the limit. The Chancellor flagged that higher inflation is with us in the near term at the very least, which will further erode the real value of the lifetime allowance.

Rishi Sunak also announced that the government will consult on changes to the charge cap (currently at 0.75%) for pension schemes to allow investment in illiquid future growth projects.

Spending

The Chancellor’s speech revealed that the Office for Budget Responsibility expects the CPI inflation rate to rise from 3.1% in September to 4% over the next year, meaning to the cost of living will continue to rise for households.

There was good news in that the planned rise in fuel duty has been cancelled. It was due to rise this Autumn and the Chancellor stated this would save the average driver £1,900. However, wholesale oil prices have been soaring, pushing up the price of a tank of fuel for drivers.

The planned rise in alcohol duty has also been cancelled. Sunak said he will streamline duty rates which are currently different across the various types of beverages. There will be just six duty rates on alcohol — the stronger the drink, the higher the rate.

Meanwhile, domestic air passenger duty has been reduced. Flights between airports in England, Wales, Scotland and Northern Island will see a lower rate of air passenger duty – it will halve to £6.50 from April 2023.

Yet at the same time, for long-haul flights over 5,500 miles to destinations including Hong Kong, Singapore and Tokyo, there will be a price rise of £7 per person travelling in economy. For destinations between 2,000 and 5,500 miles in economy will change from £84 to £87 – a rise of £3.

Earnings for youngsters

Millions of workers will get a pay rise next year when the National Living Wage is increased from £8.91 an hour to £9.50. The 59p hourly boost will mean a fulltime worker on the living wage will get a pay rise of more than £1,000 per year. The increase for all over-23s will take place on April 1.

Photo by The New York Public Library on Unsplash