This is the third blog in the series looking at cryptocurrencies and it will cover their environmental impact. Earlier posts focused on the currency aspect, what investors get when they buy cryptocurrency, and whether cryptocurrencies can be classed as an investment.

When Elon Musk tweeted that Tesla would no longer accept payment by bitcoin citing environmental concerns, this surprised a lot of people. How could something that exists in the digital world have a negative environmental impact? It’s not the bitcoin itself that has an impact, but the type of behaviours it encourages. To understand this requires a short explanation of how bitcoin works.

Think blocks!

Unlike a traditional currency which is controlled by a central authority like the Bank of England, bitcoin has no central authority. Instead, it exists on a series of computers that run bitcoin’s code and store its transaction history, known as a blockchain. Think of the blockchain as a collection of blocks recording the transactions. As every computer in the network has the same list of blocks or transaction records, the system is secure.

Every time a person sends bitcoin anywhere it creates a transaction. These are bunched together into blocks and stored as a new part of the chain. The computers that complete new blocks are required to do a lot of complicated calculations.

By way of compensation for their efforts, the system rewards the person who adds each new block of transactions, by giving them some bitcoin. This is essentially free bitcoin which can be used to buy real goods and services or converted out of the system into cash. As bitcoins have become more valuable, this reward has become more and more sought after. This is the root cause of the environmental issues.

Virtual coins, real world impact

In order to receive this reward, computers must complete the next part of the chain before someone else does, a process referred to as bitcoin ‘mining’. It’s the same thought process that triggered the 1849 Gold Rush in the old Wild West. People are now effectively competing to complete the chain first and claim the reward. Instead of picks and shovels, they do this by adding more and more computing power.

This has reached astonishing levels and the amount of electricity being consumed by competing computers is the first part of the environmental impact. The second part is that most bitcoin miners are in China. The main source of electricity in China is coal-fired power stations, which create a great deal of atmospheric pollution.

The University of Cambridge, in conjunction with the US Energy Information Administration has done a lot of work measuring and comparing the amount of electricity bitcoin mining uses. In short, its annual energy consumption is greater than the Philippines, a country of over 100 million people.

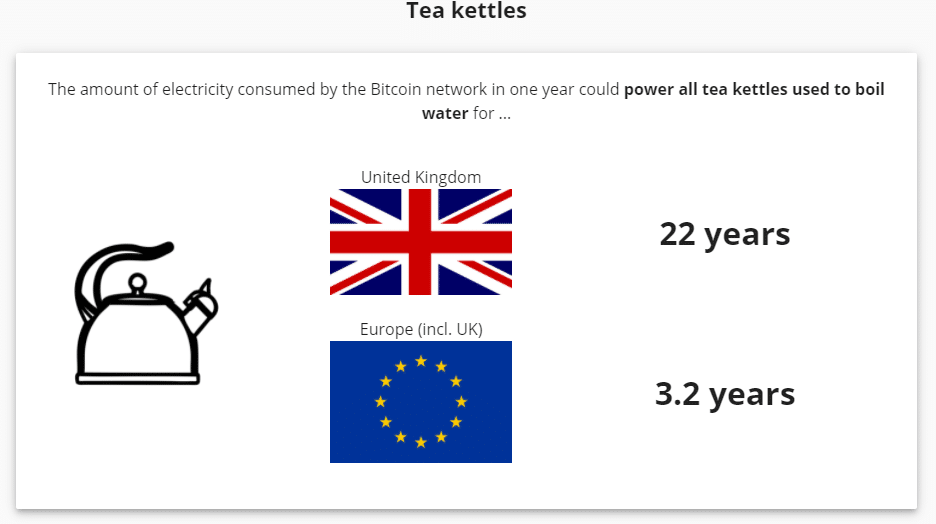

Or if you want an example that is much closer to home, then how about the fact that bitcoin’s annual energy consumption would power every kettle in the UK for the next 22 years.

Today investors are looking for more than just a profitable place to invest. They also want to ensure their money makes a positive contribution to society. This strong and growing school of thought maintains that investors should consider the environmental and social impact of companies and their activities before investing in them.

There’s no overall definition that fits all environmental and social considerations, so what matters to one person may be vastly different to what matters to another. This is reflected in the fact there is now a wide range of funds and investment strategies set up to cater for these differing opinions.

The Government in China is cracking down on bitcoin-mining activities, something that has caused bitcoin’s value to fall. However, it continues to use vast amounts of electricity. Any potential investors need to decide where this fits on their own moral compass. Can they find alternative places to invest and achieve a return without such a negative environmental impact?

If you’re interested in investing sustainably, explore Compare+Invest to find out which type of investing best suits you.

Images Source: Cambridge Bitcoin Electricity Consumption Index (CBECI)

Photo by Malcolm Lightbody on Unsplash