Being lucky enough to have lots of pensions is a good thing, but keeping track and managing them all, can be a bit of a pain. If you move all your pensions into one place, there’s less stress and paperwork and it’s easier to understand your overall retirement position.

That said, there are a few things you’ll want to consider, such as does your pension have benefits attached and can your pension be moved? Not all pensions can be transferred, and if they have final salary benefits in place (employer schemes), then it might make sense to keep them where they are. If you’re not entirely sure whether this applies to your pension, then it might be worth getting independent financial advice.

Other than making it easier to keep track of your savings, there’s a few great reasons why you may want to combine your pensions:

Lower fees

Do you know how much you’re paying in fees to your pension provider? Lots of people have no idea, but this cost can eat into your retirement fund – the higher it is, the more you’re losing. By combining all your pensions into a provider with a lower fee you could save yourself a small fortune.

Easier to manage

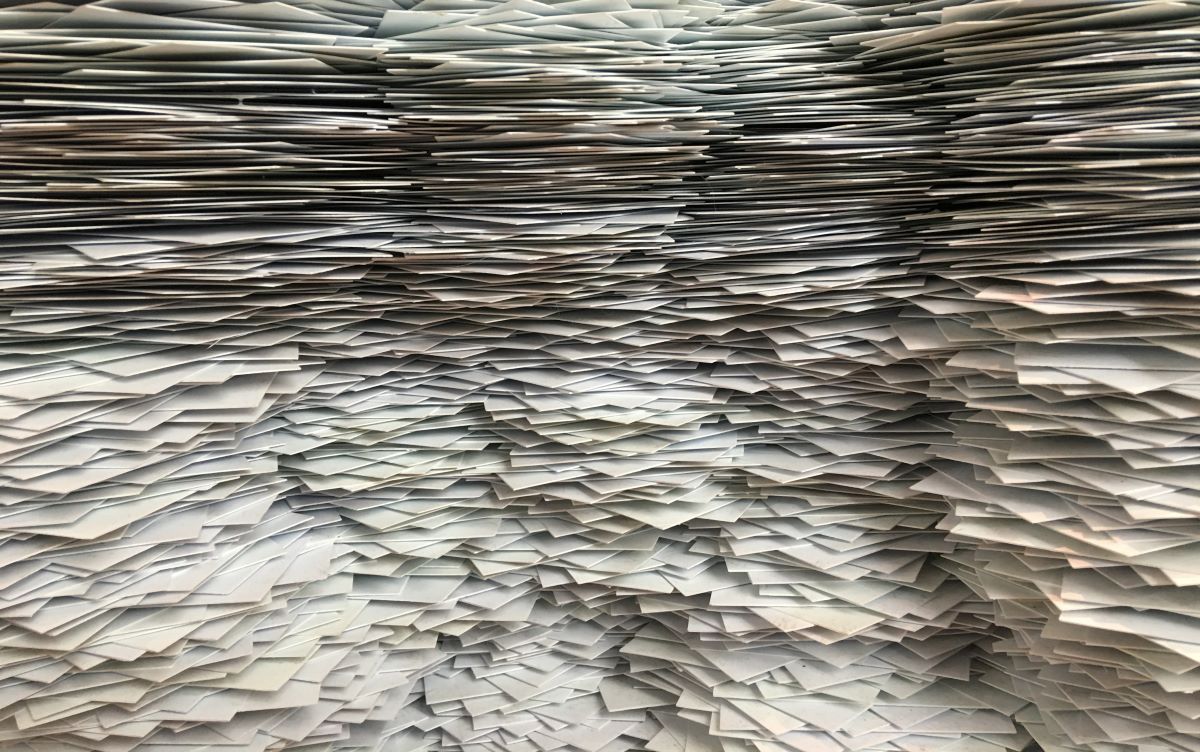

Many pension providers just send a single, annual paper statement, so if you move house and forget about that pension it could be lost. The Association of British Insurers estimates that £19bn in pensions is lost this way (click here to find out how to find your lost pensions).

Investment control

Some pension providers don’t let you have a say in how your money is invested, but you can change that by moving your pension to a provider that allows you to control how your money is invested.

Online and flexible

If you’re sick and tired of digging through drawers to find statements that give you an idea of what your pension was worth on a fixed date, then the perks of having it online probably won’t be lost on you. If you combine your pensions with an online pension provider, you’ll be able to see exactly how your pension is performing whenever you want.

Consolidating your pensions into a private pension, also gives you more flexibility over when and how you make payments, which makes planning for your retirement easier.

Should I move my pension when I change jobs?

With workplace pensions, every new job you have is likely to create a new pension. This can mean that your old one is left floundering as mine was.

If you move jobs, you could combine your old workplace pensions into one personal pension, so that you don’t lose track of it and can continue to grow your retirement funds all in one place.

A personal pension or a self-invested personal pension (Sipp) is not affected by different jobs or new workplace pensions, and you have greater control over how your money is invested.

What are the problems with consolidating your pensions?

There are lots of compelling reasons for combining your pensions into one pot, but it’s not for everyone. There are a few things that you’ll need to consider, including exit fees and loss of benefits. Some providers charge large exit fees for moving your pension. This could reduce how much your pension is worth, and in some cases, be prohibitive – check the small print carefully and seek advice from a financial adviser. If you’re transferring a workplace pension of more than £30k you will need an adviser’s approval in any case.

Lose benefits

If you’re lucky enough to have a workplace pension that comes with guaranteed benefits, then transferring it away could mean you lose those benefits. If your pension offers things like guaranteed annuity rates or a final salary pension, it’s best to keep it where it is — the loss of these benefits will far outweigh any savings you make elsewhere.

Not all pensions can be transferred – if you work for the NHS, a school, or the government, the chances are you’ll have a public sector pension. These pensions can’t be transferred, so you’ll need to make sure you keep track of it.

Consolidation tips

If you’re fed up with hunting around for papers and you just want to easily combine all your pensions, then here are some tips that can help make things a little bit smoother:

Know who your providers are

The first thing you want to do is find who your pension providers are. Go back through any paperwork and try to find the workplace pension you had at each of your jobs. If you’re not sure who that provider was, then the government’s Pension Tracing Service may be able to help.

Find your policy number

Once you’ve found your provider, next you’ll need to know your policy reference number which can be found on any paperwork they’ve sent to you. If you can’t find this, get in touch with the provider – after a few security questions, they should be able to tell you your policy number.

Pick a new provider

This could be the hard part. There’s lots of pension providers available, so you want to do your research to find one that suits you. Low fees are important, as this will directly affect how much you’ll have in your retirement pot, but you also want to see what they offer – can you manage your pension online, do you have a choice in how they’re invested, and are they regulated by the Financial Conduct Authority? These are all important considerations to make. You can use our calculators to help you find the right investment platform for your circumstances – here.

Move your money

Once you’ve done your research and picked a provider, you’ll just need to let them know you want to move your old pensions to them. They’ll generally ask you who the provider is with, your policy number and how much you want to transfer, and then they’ll do the rest – all you need to do is sign a document.

Plan ahead

With all your pensions in one place, all that’s left to do is plan ahead and monitor your investments to make sure they’re on track. Be prepared to be proactive and adapt your retirement plan. If you planned to retire at 55 and go fishing, but you won’t have enough until you’re 60, you can either up your contributions, retire later, or do a combination of both.

Photo by Edge2Edge Media on Unsplash

Photo by Christa Dodoo on Unsplash