So, who is Nutmeg? You may have seen their familiar green and black adds online, out and about on the tube or just generally on your travels. Nutmeg helps customers start investing by asking some simple questions online and creating and managing a suitable investment portfolio for them. It is arguably one of the best known robo-advisers in the UK and is now owned by American bank, JP Morgan Chase, which funds its developments.

Nutmeg is trying to bridge the gap between the traditional way of investing, which involves meeting a human adviser, and technology. It has combined the best of worlds and created a robo-adviser or digital investment app. This allows it to offer the service to a wide range of investors at a reasonable price.

What do you get?

Nutmeg provides a great app which operates both on Android and iOS so that you keep track of your investments on the go. It has a range of online investment products that will meet the needs of most investors, including a pension, several ISAs and a general account which can hold company shares. There is still a human investment and support team on hand to manage the day to day. Don’t worry, it’s not the investment version of a dating app!

Is it easy to setup?

The initial setup is quick and easy. You’ll need a few things to hand such as your national insurance number and bank details. That’s just to get the account open — you will not be charged anything at the outset.

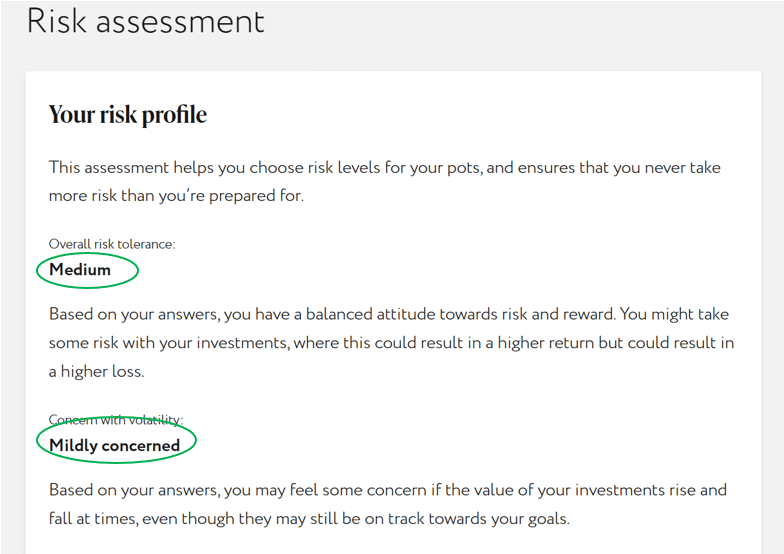

The whole service centres around the questionnaire you fill in. It has the slightly off-putting name of a risk questionnaire, but it is simple to understand and complete. The answers you give allow an adviser, or robo-adviser in this case, to understand who you are, your financial situation and motivations for investing. It will ask you questions about how often you check your portfolio, and how anxious you might get about your investments, to gauge which portfolios are most suitable for you.

The user experience is nice and smooth here. It’s quick and easy to move through the questions and at the end of it you will have your Risk profile which is explained in straightforward language. If you are unhappy with the results, you can go back and redo the questionnaire or get in touch with the customer services team to discuss, so all good so far.

Making it your own

It gets more fun after the questionnaire. You can name your account to help you keep track of what it’s for. So, you could call it My first house or My Lamborghini fund, whatever makes you comfortable and helps you keep track.

This is a great feature in Nutmeg and the ability to create multiple pots means you really can distinguish your savings pots and work towards personal goals.

It’s not just one-and-done either. You can start to invest with a lump sum of £500, but can also contribute on a monthly basis, via direct debit, of say £100 or £200. This is great if you want to put a percentage of your monthly salary into savings.

What are my investment options?

The great thing about Nutmeg is you don’t have to choose your investments. You can sit back, relax and know that work will be done for you. So, what are the options? What might you be invested in? Well Nutmeg has four portfolio ranges. They’re all a little bit different in style and what they hope to achieve, so let’s take a look.

Fully Managed – these are what you might call ‘the originals’ and are proactively managed by the Nutmeg investment team. They regularly review the portfolios and make strategic adjustments to try to minimise losses and boost returns.

Smart Alpha – these portfolios are powered by JP Morgan Chase (Nutmeg’s owner) who will adapt your portfolio depending on changing market conditions. This is supported by their own in-house research.

Socially Responsible – with a focus on positive impact the socially responsible portfolios (SRI) favour companies that have higher environmental, social and governance (ESG) standards. They are proactively managed by the Nutmeg investment team in-house.

Fixed Allocation – Lower cost and lower intervention. These portfolios are built to perform without the intervention of the Nutmeg team. However, the portfolio will still rebalance to ensure investments are in line with your risk score.

Performance

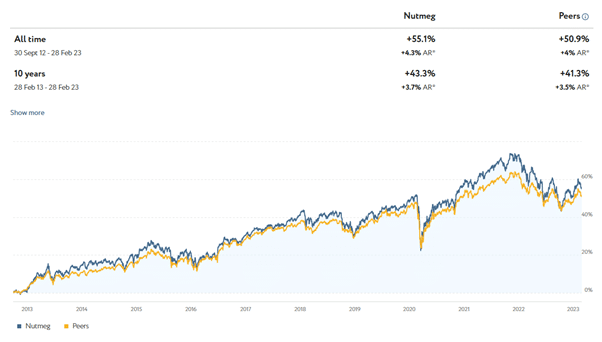

The portfolios have, to date, performed well against their peers and below you can see an example of a Fully Managed portfolio against its peers over the last 10 years.

Nutmeg has done a great job in recent years of expanding its portfolio ranges, with more recent additions of Socially Responsible and Fixed Allocation. We don’t think it will stop there, so keep your eyes peeled for future enhancements.

Final steps

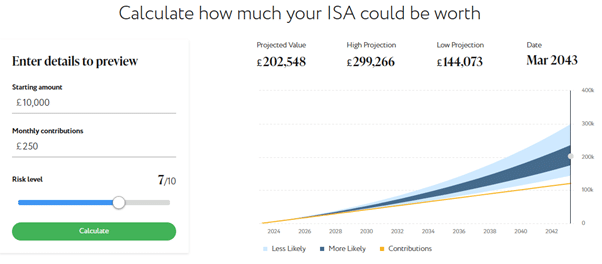

To finish the setup, you will be taken through the usual steps — agreeing to terms and conditions and being shown an overview of costs and charges and projections of what your pot might look like in the next 5 or 10 years.

In particular, the ISA and Pension Calculators are worth a look, they are simple to use and give you a peak into the future to see how your investments might grow. Once completed, you will be taken to your dashboard to see all the key details of your investments.

What does it cost?

The Nutmeg fees include the cost for holding and administering your portfolio, as well as the investment portfolio itself. They are shown as a percentage of the amount you invest. The fixed allocation portfolios cost less as Nutmeg does less ongoing work to do to maintain them. Charges fall if you invest £100k+, so it becomes more cost effective for larger investors.

| Portfolio charge | Average investment cost | |

|---|---|---|

| Fully Managed | 0.75% up to £100k, 0.35% beyond | 0.21% |

| Smart Alpha | 0.75% up to £100k, 0.35% beyond | 0.35% |

| Socially Responsible | 0.75% up to £100k, 0.35% beyond | 0.30% |

| Fixed Allocation | 0.45% up to £100k, 0.25% beyond | 0.19% |

What’s the verdict?

All online investment services have their pros and cons. Nutmeg is a popular investment provider and it’s easy to see why. The user experience is great and it’s no surprise to hear that it has won several awards.

The costs might be seen as a little high compared to others – though Nutmeg does become more favourable over £100k. It also requires an initial lump sum of £500 to get started so this could be a barrier to anyone hoping to start with a smaller amount on a monthly basis.

That said, there’s a lot to like here. Nutmeg has thought a lot about customer service and support. It has an online chat function as well as the ability to call and speak to a real adviser. Overall, Nutmeg is a great option allowing you to access investment expertise without having to lift too much of a finger to do it.

Photo by Alex Knight on Pexels