Moneyfarm is a digital investment provider that offers a broad range of accounts and portfolios. It is essentially a do-it-for-me investment provider, which means that investors do not have the headache of selecting investments themselves.

Moneyfarm launched in the UK in 2016, having successfully managed money for investors in Italy since 2011. It was built to offer an innovative, low-cost, robo-advice solution for both novice and seasoned investors.

Getting started

Moneyfarm offers all the main accounts such as an ISA, a pension and general investment account. It also offers Junior ISAs. The first step before opening an account is completing a risk questionnaire. This assesses your attitude to risk and determines your investor profile. It’s an important part of the advice process as it allows Moneyfarm to learn more about you, your financial situation, and your motivations for investing.

The questionnaire is simple and easy to complete. For example, it asks how strongly you agree or disagree with statements such as I often feel anxious about my investments, and frequently check on their performance. It will also ask about your existing knowledge of investments, particularly ETFs and funds.

Once you have completed the questionnaire you will be presented with your investor profile and asked to confirm before continuing. It’s at this point that you choose the kind of account you would like to open, such as ISA or a pension for example. Once you have chosen the type of account, you’ll be presented with the different types of portfolio options available: Actively Managed, Fixed Allocation or Cash.

Portfolio choice

Moneyfarm launched five Fixed Allocation portfolios at the end of 2022. The five are a lighter-touch, lower-cost option for investors. The investing goals are essentially the same as actively managed portfolios, but investors do not benefit from active management and regular rebalancing by the asset allocation team hence the cheaper price.

They also launched three new thematic portfolios, called Megatrends that focus on three key themes: technological innovation, demographic and social change, and of course, sustainability.

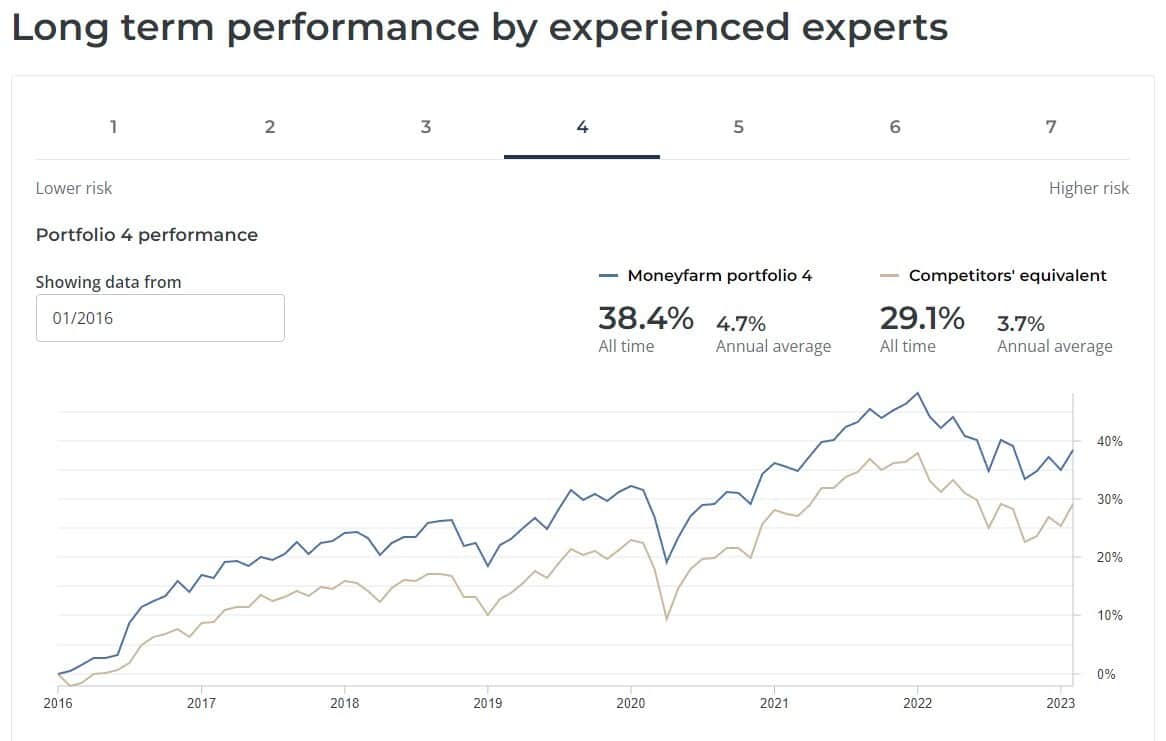

Once you’ve decided how you want your investment managed, you are then offered one of seven portfolios that Moneyfarm believes best matches your investor and risk profile. These come in socially responsible (ESG) portfolio or Classic (regular mix) flavours. Lots of information is presented on the portfolios including and how it has performed to date. Below is an example of historical performance charts.

Investments

Moneyfarm invests exclusively in ETFs or exchange-traded funds, which are a type of investment vehicle that aim to mirror or track a particular sector, commodity or geography such as the FTSE 100, Gold or Asia Pacific. They are usually passive funds and they can be bought and sold on the stock market just like stocks and shares, which gives them a more flexibility than standard investment funds.

The pros

One of the biggest USPs of the Moneyfarm platform is that you get your own personal investment consultant. That means there is someone on the end of chat, email or telephone to talk you through your investment portfolio and investor profile. No other robo offers this personalised advice approach so it’s a great feature and USP.

Moneyfarm users benefit from a simple fee structure. Investors pay one management fee for their account and the active management of their investment portfolio. The use of low-cost ETFs helps to keep the overall costs down too. For an actively managed portfolio the fee ranges from 0.75% for portfolios with less than £10,000 (which equates to £75 per year) to £0.35% for portfolios with more than £500,000, which equates to £1,750 per year.

The website and app are very user-friendly and ease to use. The initial application can be completed in about 10 minutes, including the risk questionnaire. Most of the feedback for the platform is positive and it’s obvious that technology and efficiency are important to the Moneyfarm team.

Are there any cons?

Moneyfarm gets plenty of great feedback and the company is continuously enhancing and introducing new features. There are guides and ebooks on their website, but we would like to see this expanded for investors. Perhaps more on market insights and more tools to help new investors get to grips with the world of investing would be useful.

Moneyfarm is fairly transparent performance wise. It shows portfolio performance against composite average returns for similar risk-profiled portfolio solutions. A well-known company, Asset Risk Consultants (ARC) provides the composite data. What is unusual is that Moneyfarm appears to have outperformed the ARC composite indices for every portfolio in every year, although this is probably linked to the fact that averages and not actual returns are being used and that will lower the overall performance.

Moneyfarm does not show performance against well-known stock market indices such as the FTSE 100, FTSE All Share or the FTSE World indices. Using stock market indices would allow give investors a better idea of portfolio performance.

Overall, Moneyfarm is a great platform for investors who don’t want to pick and manage their own investments. A good do-it-for-me option. What’s more, Moneyfarm is a cost-effective automated solution that also gives access to a reassuring human being at the end of the line.

—

Photo by Gozha Net on Unsplash.com