The average Brit is likely to have six jobs in his or her lifetime, while millennials are on track for at least 12 by the time they retire. As every company has its own workplace pension scheme, that means that you’ll be accumulating pensions at the same rate as your jobs.

Keeping up with that many pensions is a huge task, so it’s no wonder that the Association of British Insurers has estimated that there’s around £19 billion worth of lost pensions in the UK just because people have moved house!

The good news is that tracking down old pensions is pretty straightforward. But before you do anything else, check all the pension paperwork (probably stuffed in with your payslips) that you might have accumulated over the years.

I struck gold!

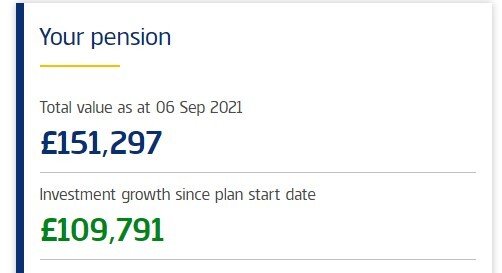

It’s definitely worth looking for old pensions, as I discovered last year. Having sorted the house and garden during lockdown, I finally turned to my finances, and discovered, to my amazement, a £150,000 pension pot! Yes, you read that right, £151,297 to be exact!!!

Let me tell you how. In 2001, I joined a small firm and paid into the pension until 2007 when the firm was acquired by a multinational company and we joined its much bigger pension scheme. The original pension was never transferred, and I don’t remember anyone ever discussing what we should do with it and so it was left dormant.

I kept meaning to do something about it, but over time I forgot. I knew I had a stakeholder pension through Standard Life, but in my head I hadn’t paid in very much into it, so it was small and worth no more than about £30,000. That’s not a figure to be sniffed at, of course, so I set about trying to find out and lockdown boredom gave me staying power.

How much??

The first inkling that my pot might be bigger than I thought it was, was when I was transferred to the Priority Plus team at Standard Life for large personal pensions. As you can see from the image below, my total contributions during the six years were £41,506, but the investment has grown by a whopping £109,792 — even though I stopped contributing in 2007 and fees have taken a bite out of my pension ever since.

So how did I establish such a large pot? There were three main factors. Firstly, I was young, naive and had time on my side so I stuck everything into equity. I knew a lot less then than I do now, but I spread my pension contributions between UK, European, US, Global and Emerging Market equity.

The second thing was that I selected passive investment funds (index-trackers), and finally, I left well alone. In the 19 years since I started this pension, we’ve had boom and bust years, but my pension remained invested throughout and it’s paid off handsomely.

How to find old pension funds

Hopefully, this story has inspired you to track down every pension and monitor them closely. There are several ways you might have lost a pension:

- You know who the provider is but don’t know your pension policy number

- You don’t know the provider or your policy number

- You’re not sure who your old employers’ pension schemes were with

- Depending on which of the above you fall into, there’s a way to track down your pension (or pensions).

Finding a lost pension

You should get annual statements in the post from your current and previous employers. If these have stopped arriving, check your filing system — even an old statement will have enough information to help you get in touch with the pension provider. Give them a call and they’ll ask you a few personal details and security questions to help you find that missing pension.

Finding a workplace pension

If you believe that you had a workplace pension, speak to your previous employer and they should be able to help you track it down. It might have been a while since you worked there. but they’ll have a record of the provider. Make sure you give them the start and end dates of your employment period. Once you know who it is, get in touch with the pension provider directly.

Finding an unknown pension

Some companies might not have great records, especially smaller ones, some might have gone out of business, and some may have been acquired or merged. However, you can still track them down through the The Pension Tracing Service, a government service that can help you find your lost workplace or personal pensions. You need to know the name of your company and in the case of a personal pension, the name of your provider.

This free service checks over 200,000 workplace and personal pension schemes. If you do it online and get a ‘no matching results’ page, then you could try phoning them on 0800 731 0193 and see if you have better results that way.

Found it!

Once you’ve got your hands on your pension, the first is to simply keep track of it — after all, you took the effort to find it once, and you don’t want to do that again! The next step to consider is whether bring all your lost pensions together in one pension. To do this, you open a personal pension or a self invested personal pension (Sipp), which you can take with you even if you change employers.

Having all your pensions in one place doesn’t just make it easier to track your pensions, it also means that you can manage your investments and management fees better too. I have decided to consolidate all my pensions into a single Sipp (self-invested personal pension).

My next blog will be about the pros and cons of consolidating pensions.

Photo by AbsolutVision on Unsplash