Understanding LISA interest rates: a comprehensive guide

Understanding LISA interest rates is crucial for individuals looking to make informed d...

Well, there’s no hard and fast rule because saving is a personal thing. You need to do what suits your own scenario, as we go through our own investment journey due to timing and allocating your savings towards your savings goals. It is a great step to get started towards growing your financial freedom.

Create a good balance with your savings & disposable income. How much should I save? Why don’t you be the judge!

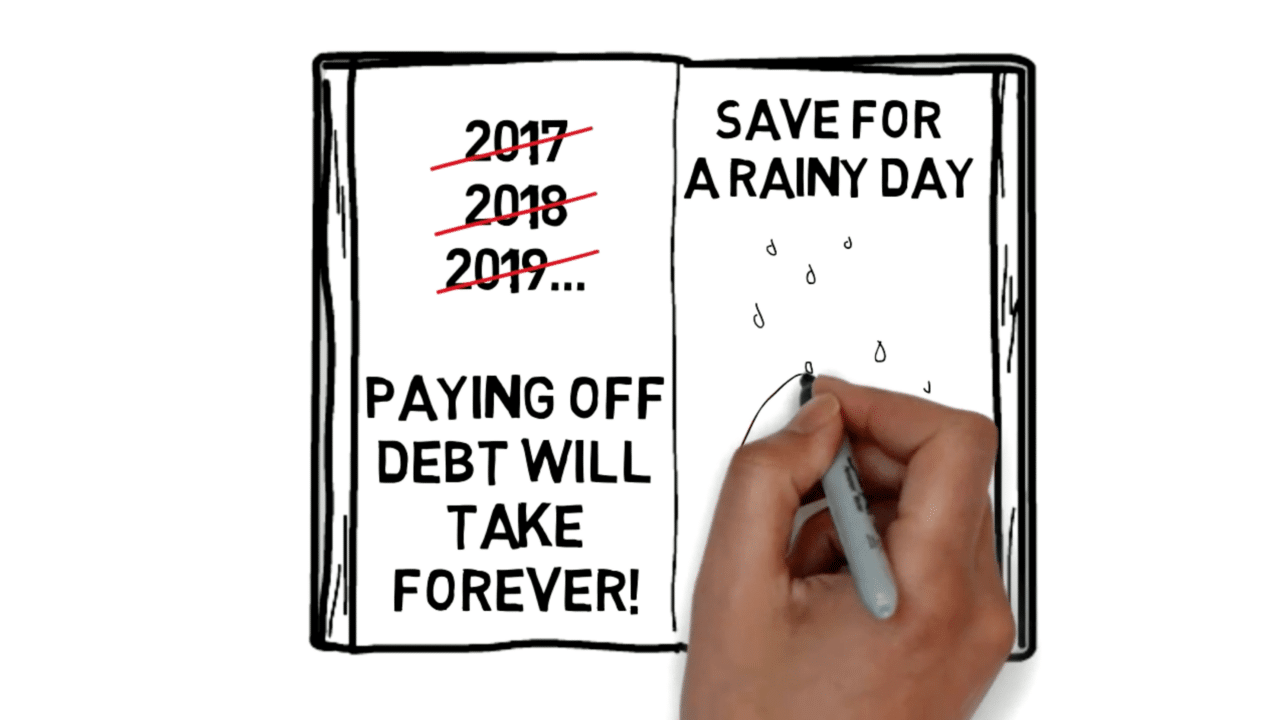

Take a look at the video that explains…

How much should I save?

Saving is a very personal thing… and there are no hard and fast rules. You should always try to pay short-term debts such as loans and credit cards off, as quickly as you can, because the charges will be higher than the interest you can earn on your savings and investments. Sometimes, that’s not easy to do! Or it will take a long time… so you might want to set aside some savings at the same time. Your disposable income is the money you have left once you’ve met your living expenses. A basic rule of thumb is to divide your disposable income into things that matter that might be going out, saving for a holiday, or saving for a house deposit. It doesn’t matter how small the amount is, what matters is that you’re saving. It’s all about balance. If you spend too much on life’s luxuries, or your savings plan is unrealistic, you’ll quickly fall off the wagon!