Understanding LISA interest rates: a comprehensive guide

Understanding LISA interest rates is crucial for individuals looking to make informed d...

We took the pulse of the Great British Wealth Off experiment on 2nd November 2018 after a sharp correction in the stock markets. The FTSE 100 closed 2018 down 12% on the previous year, but during the three months under review, it fell by 8%. It would be fair to assume that the investments in the Great British Wealth Off will have fallen by similar amounts.

Here’s a little recap. We started this experiment nearly two years ago on 2nd February 2017 with the aim of demonstrating that there is no right and wrong way to invest. In the last few years, investors have been led to believe that almost every type of investment is wrong except for passive investments managed by algorithms. So we set out to find out if the argument stood up to the test.

We invested £300 in a range of single- and multi-manager investments, some passive some active, in three different ways (direct from the manager, through a DIY platform or through an adviser). All the investments are in the mixed 40-85% sector apart from the Hawksmoor fund, which is in the 20-60% share sector, and the Robo, which was in the second highest risk classification. Overall, we made six investments in three different ways (including two control portfolios put together by Graham Bentley).

When the experiment started in 2017 the stock market was relatively calm and in the ascendancy. But 2018 has been characterised by choppy and volatile markets – so how have our investments been affected?

| Investments | Type | Aug 2018 (£) | Nov 2018 (£) | Qtr Grth % | Grth since start % | SRRI |

|---|---|---|---|---|---|---|

| RL Sustainable World, DIY plat | Active | 374.61 | 357.18 | -4.7 | 19.1 | 5 |

| RL Sustainable World, direct | Active | 374.70 | 357.09 | -4.7 | 19.0 | 5 |

| RL Sustainable World, adv | Active | 370.68 | 352.80 | -4.8 | 17.6 | 5 |

| Active portfolio, DIY plat | Active | 344.91 | 331.53 | -3.9 | 10.5 | 4 |

| Vang LifeStrategy 80% Eq, direct | Passive | 343.08 | 329.97 | -3.8 | 10.0 | 4 |

| Active portfolio, direct | Active | 343.23 | 329.67 | -4.0 | 9.9 | 4 |

| Vang LifeStrategy 80% Eq, DIY plat | Passive | 341.79 | 328.53 | -3.9 | 9.5 | 4 |

| Active portfolio, adv | Active | 341.28 | 327.48 | -4.0 | 9.2 | 4 |

| Vang LifeStrategy 80% Eq, ad | Passive | 338.19 | 324.51 | -4.0 | 8.2 | 4 |

| Architas MA Active Prog, DIY plat | Active | 339.90 | 324.33 | -4.6 | 8.1 | 4 |

| Architas MA Active Prog, direct | Active | 337.62 | 321.66 | -4.7 | 7.2 | 4 |

| Architas MA Active Prog, adv | Active | 336.36 | 320.37 | -4.8 | 6.8 | 4 |

| Passive portfolio, direct | Passive | 333.36 | 320.13 | -4.0 | 6.7 | 4 |

| Passive portfolio, DIY plat | Passive | 332.16 | 318.81 | -4.0 | 6.3 | 4 |

| MI Hawksmoor Vanbrugh, DIY plat | Active | 325.17 | 318.60 | -2.0 | 6.2 | 3 |

| MI Hawksmoor Vanbrugh, direct | Active | 322.77 | 315.84 | -2.1 | 5.3 | 3 |

| Passive portfolio, adv | Passive | 328.68 | 314.91 | -4.2 | 5.0 | 4 |

| MI Hawksmoor Vanbrugh, adv | Active | 321.78 | 314.70 | -2.2 | 4.9 | 3 |

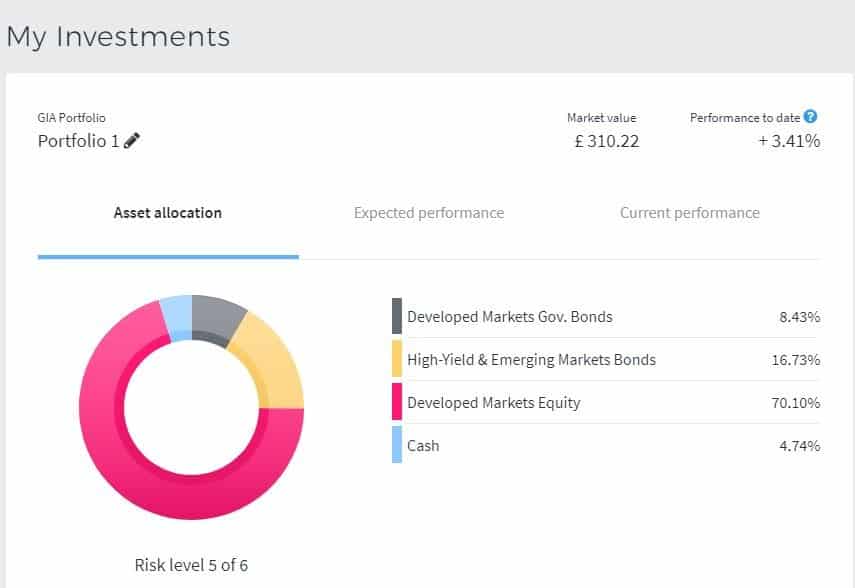

| Moneyfarm | Robo | 323.55 | 310.22 | -4.1 | 3.4 | 6 of 7 |

| FTSE 100 | 4,165.55 | 3,904.31 | -6.3 |

Despite the stock market volatility, the Royal London Sustainable World Trust once again topped the table with assets of £357.18. It has grown by 19% since the start of the experiment compared to just 3.4% for the Moneyfarm investment which continues to flounder at the bottom of the ranking with assets of £310.22. Basically, it’s only earned a tenner between February 2017 and November 2018. Shocking, right?

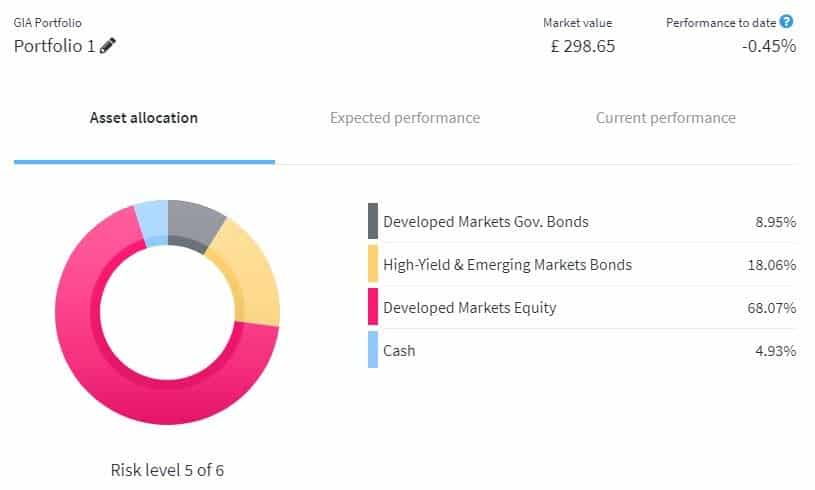

So how come these two investments have performed so differently? Apart from the fact that the RL trust is actively managed, the answer lies in the asset allocation differences. The Moneyfarm robo has a significant percentage of its assets (30%) in fixed income or cash. Developed market bonds represent around 8% of the assets and emerging market bonds, another 17%.

The RL Sustainable World Trust holds just 15% of assets in fixed income. The trust has a bias towards equities and is overweight compared to its peer group because the manager believes equities offer greater opportunities than bonds to generate returns, particularly in the current low-yield environment. The equity bias has helped to underpin its growth for much of the past two years.

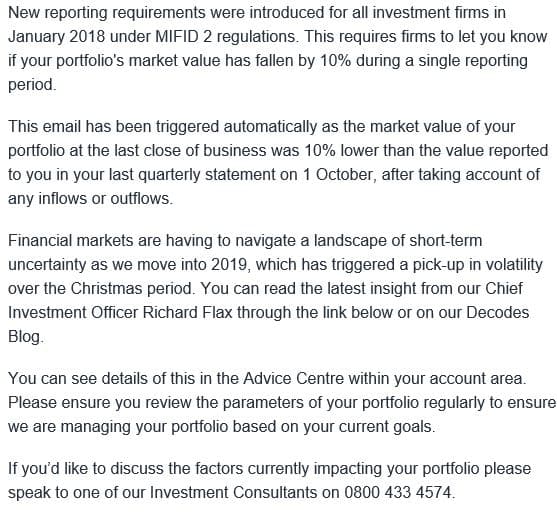

What’s more, the Moneyfarm investment has gone from bad to worse. Moneyfarm apparently de-risked the portfolio in the October re-balancing but it’s difficult to know what changes were made and how they were expected to protect the portfolio from further shocks. On 27th December, I received the following email from Moneyfarm (as now required by MiFID2 regulations) alerting me to the fact that my investment had fallen by more than 10% in the fourth quarter.

Today my Moneyfarm investment stands at £298.65, which is below the £300 I invested in February 2017. Let’s hope it has improved before the experiment’s second anniversary on 2nd February 2019. It will be interesting to see what impact, if any, this prolonged period of volatility will have on the Great British Wealth Off. Look out for our update in February…

Happy new year!