The first of our robo review series

You should have heard of Nutmeg, especially if you’re under 40, a young professional and live in or near London. This is the customer group Nutmeg focuses its advertising on. Though it has ventured onto TV and is now the most recognised Robo brand in the UK, it has an unashamedly Hipster following (cue memes about cleaning living and avocados).

There’s a lot to like about Nutmeg. It’s for time-strapped workers who want somebody else to keep an eye on their investments. Nutmeg can adjust the investment content as necessary to keep you on target, but at reasonable cost.

This is so-called Robo Advice and Nutmeg was doing it before anybody else in 2012, and for hipsters that’s pretty cool. It’s much lower cost than face-to-face advice, but higher than DIY platforms where investors select their own investments or pick from shortlists.

Ease of use

But the point about Nutmeg is not the cost, but the user experience and accessibility. From the outset, the platform was designed to be mobile-enabled and supports Apple, Android, tablet and PC users. All transactions bar some pension and detail changes can be done using your phone.

There are a few tools too, for example, a pension contribution checker, but as you’re not doing any picking and monitoring, you don’t really need much. What is good are all the videos and Nutmegonomics market updates which are engaging and seem personal. CEO, Martin Shead, and Investment Officer, Shaun Port, are the front men and Nutmeg feels trustworthy in a BBC kind of way, which matters in this market.

Accessibility also means being able to get started. A face-to-face adviser may take you on as a client if you have £50,000 or more to invest whereas Nutmeg allows you to start with a £500 lumpsum if you can also put by £100 a month. Otherwise the minimum is £5,000, which is a tad higher than most robos but fits their customer group.

The Lifetime ISA is an exception and starts at just £100 per month. Some robos allow you to start with £1, but it means they gather large customer numbers with tiny amounts; higher minimums means Nutmeg gets customers that have real intent to save.

Customer journey

The customer journey (as webby people like to call it) does take the promised ten minutes and starts by requesting your e-mail address. The page movement is smooth and links naturally, though you sometimes have to scroll down to read it all. There is good support at all stages of the sign-up process, but it’s possible to get distracted and wander off the sign-up journey if you’re inquisitive… (like me).

Being a technology company rather than an investment company, Nutmeg approaches things in a different way to others. An early question asks if you want to invest in an ISA, Pension, Lifetime ISA or General Investment? An adviser would, of course, find out about you and your objectives and then decide the best destination(s) for your money.

It’s a limitation of Robo advice that it can’t understand customers as such and manage competing needs — they can only cope with one investment need at a time. But to be fair, if you were to open an account on a DIY investment platform, you’d also have to make a similar decision.

The general account and ISAs can be used to park cash while you make up your mind or disinvest. Nutmeg applies a 0.25% fee to hold the cash, but currently pays 0.40% interest on it. Nevertheless, it’s not a good idea to leave it there too long as it won’t grow, but it’s a good feature to have…especially if markets turn very rocky in 2019.

Portfolios

Investment Portfolios come as Fully Managed, Socially Responsible and Fixed Allocation. Nutmeg uses a selection of Exchange-Traded Funds (ETFs) to construct them. ETFs are essentially investment funds that can be bought and sold on the stock exchange. They’re mainly index-trackers (passive), but active investments are also available.

The type used by Nutmeg comes from a range of providers that offer simple ETFs backed by real assets, including cash, bonds and equities. Nutmeg picks the best mixture of different ETFs to produce the performance expected by the customer and in line with his or her risk profile.

Fixed Allocation means the underlying ETF mix is fixed; it won’t change if markets go up or down. Fully managed allows Nutmeg to use its discretion to re-balance the portfolio in response to market movements. Meanwhile Socially Responsible uses the same fully managed approach, but filters out harmful and unethical investments — and among their supporters, this is a big deal.

Nutmeg makes a lot of its green, ethical and social values and to be fair lives by them culturally. All its investments are subject to Ethical Social Governance (ESG) checks and there is a detailed explanation as to what cannot be held as investments. Negative screening is used rather than positive engagement as Nutmeg holds the ETF rather than the physical underlying assets (if you don’t hold these you can’t apply positive influence).

Risky behaviour

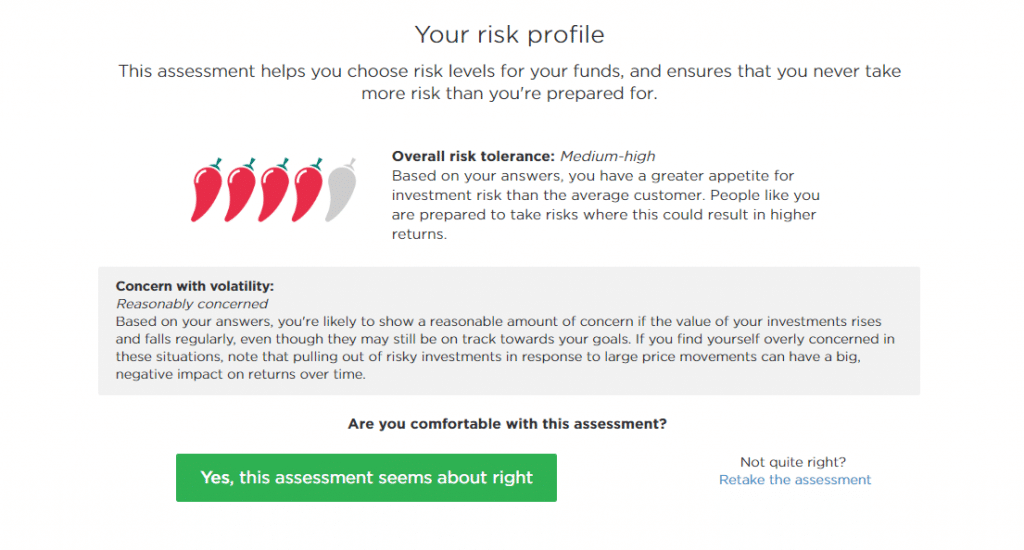

Nutmeg poses eleven risk tolerance questions. These determine how you’re likely to react to falls in the value of your investments and reveal how far you would push to make the most money possible — as in life, you have to take more risk to get bigger rewards. The choice is made using mobile-friendly sliders.

Risk comes out on a one-to-ten scale for the fully managed and socially responsible portfolios and one to five for fixed. The questions are used to produce a fan chart which forecasts different outcomes and their probability. The profiles also show your one to five Chilli rating — this makes risk really clear and rather better, and I suspect cheaper than the latest incomprehensible MIFID2 regulations.

The end journey

The last bit is when the personal details are collected, and the account is all set up. The account shows costs in percentage and pound amounts for the next twelve months, which is nice and clear.

In October 2018, Nutmeg launched a telephone advice service. A similar questionnaire is filled in and an initial phone conversation with an adviser comes free of charge. Nutmeg levies a one-off charge of £350 for tailored recommendations. This is what is known as regulated advice, so an investment may not be the outcome, but if there is it can only be for Nutmeg products.

This is only a step away from the face-to-face advised model Nutmeg says it wants to disrupt but is a one-off cost and cheaper than similar phone-based services. The Nutmeg site is good enough not to need advice, but my guess would be that customers need help with pensions in particular.

Not quite peanuts

Compared to other robos, the price for a fixed allocation portfolio is fair at 0.71% for the all-in cost but the cost of the fully managed option is 1.02% which is far less competitive. The socially responsible option is 1.16% but that may not matter if that’s important to you and it compares well with other SRI investments.

| Investment | £5,000 | £10,000 | £25,000 | £50,000 | £100,000 | £200,000 |

|---|---|---|---|---|---|---|

| Fixed allocation | £36 | £71 | £178 | £355 | £710 | £1,220 |

| Fully Managed | £51 | £102 | £255 | £510 | £1,020 | £1,640 |

| Socially Responsible | £58 | £116 | £290 | £580 | £1,160 | £1,920 |

The all-in cost reduces for any amounts above £100,000, which is well within reach for many as Nutmeg encourages pension transfers and employer contributions (it keeps the price competitive and stop wealthier portfolios walking).

The pension only allows the fully managed option so has the higher 1% charge throughout. Nutmeg will be absorbing costs here as it has to pay a pension provider (in this case Embark Pensions) and pensions cost more to run. I searched for hidden or ‘gotcha’ charges and couldn’t find any, so top marks for keeping it clean and simple. In pound terms, this shows the cost of investing for over one year.

The Nutmeg price can be pared back even more by using one of the deals they have struck with sites like This is Money (no fees for six months), Avios/British Airways (Avios points), deals for KPMG employees, £100 for Clear score customers, cashback from Quidco etc.

If you’re avant-garde there are probably more on Instagram or Tumblr, so it’s always worth looking for a deal. There is also a £100 cashback offer for introducing a friend to Nutmeg which should pay for a few low-fat non-whip frappes at Starbucks.

Saving tip – if you go straight to a provider’s site you won’t find any deals, but google your favourite brand and add keywords like + offer + deal + cashback and Bob’s your uncle!

Performance

| Portfolios | 1 Yr Nutmeg | 1 Yr Benchmark | 5 Yr Nutmeg | 5 Yr Benchmark |

|---|---|---|---|---|

| 1 Minimise potential loss | -0.5 | 3.3 | ||

| 2 Minimise potential loss | -2.5 | 7.5 | ||

| 3 Slow and steady growth | -3.6 | -3.8 | 8.7 | 11.7 |

| 4 Slow and steady growth | -4.4 | -3.8 | 11.9 | 11.7 |

| 5 Moderate growth without extreme volatility | -5.9 | -5.1 | 12.8 | 17.1 |

| 6 Moderate growth without extreme volatility | -7.1 | -5.1 | 14.4 | 17.1 |

| 7 Higher growth accepting higher volatility | -8.2 | -5.7 | 19.4 | 23.2 |

| 8 Higher growth accepting higher volatility | -9 | -5.7 | 22.4 | 23.2 |

| 9 High growth by accepting very high volatility | -9.7 | -5.9 | 26.3 | 26.6 |

| 10 High growth by accepting very high volatility | -9.8 | -5.9 | 29.8 | 26.6 |

Nutmeg should be able to show six years of past performance and says it is transparent, but I didn’t find it easy to locate on the site and it wasn’t that meaningful either.

As they run discretionary style portfolios it’s not easy for analysts to work this out or benchmark it. I’ve shown five-year cumulative performance in a single table. The benchmark Nutmeg prefers is based on a peer group of wealth managers (all figures are after charges).

The customer would better understand the comparison against a deposit account or the FTSE Al-Share. Generally, Nutmeg underperformed its benchmark and one-year performance is negative for all portfolios (but 2018 was like that for everybody).

The Risk 10 high-growth portfolio has outperformed over five years but, asset allocation and ETF use alone will not deliver expected returns in the current market, Nutmeg like other multi-asset managers need to articulate how they will manage in a low return environment where bonds may correlate more closely with equities.

Backers

This can’t be ignored as Nutmeg hit the headlines in January with a fundraise that saw £45m being injected by Goldman Sachs. This is in addition to £30m raised in 2016 from Hong Kong-based Convoy and £12m from a bank in Taiwan. As a Fintech company, they have been able to raise this with relative ease, but Nutmeg is burning a lot of cash to grow a business well short of scale. Goldman believes this is a massive long-term prospect, but fin tech is risky and success depends on the continued backing of the venture capitalists.

Nutmeg has 60,000 customers and manages over £1 billion of assets which is big but way short of the £90bn run by Hargreaves. Nutmeg is distinctly different. 40% of Nutmeg customers have never invested before; they’re younger than average and have a higher proportion of female investors — for this achievement Nutmeg deserves credit

*Nutmeg is a fruit not a nut.

—