Fidelity Personal Investing, the third largest DIY platform in the UK, has announced that it acquired Cavendish Online Investments on 2nd October 2020. Cavendish’s investment arm was already powered by Fidelity’s FundsNetwork platform, so the transfer from Cavendish to Fidelity should be seamless and straightforward, with account credentials remaining the same.

Overall, this is good news for Cavendish clients. The Cavendish platform is essentially several services loosely stitched together — investments through ISAs, general investment accounts and pensions (underpinned by the Fidelity platform), a life insurance comparator, and structured products. There was no single login and unified service, and it felt disjointed and clunky.

Despite styling itself as an alternative to expensive financial advisers, its service has always been more discount brokerage than holistic advice. Now that Cavendish has sold off the investment arm, its focus will be life insurance for which at charges at flat £25, although it plans to revive its structured product and VCT service.

The Fidelity service

As full customers of Fidelity Personal Investing, Cavendish Online investors will benefit from an extensive range of funds, shares, investment trusts and exchange-traded funds, which can be held in an ISA, SIPP or investment account. They’ll also be able to be able to access Fidelity’s research, guidance, investment tools and market insights as well as its recommended fund lists and portfolios.

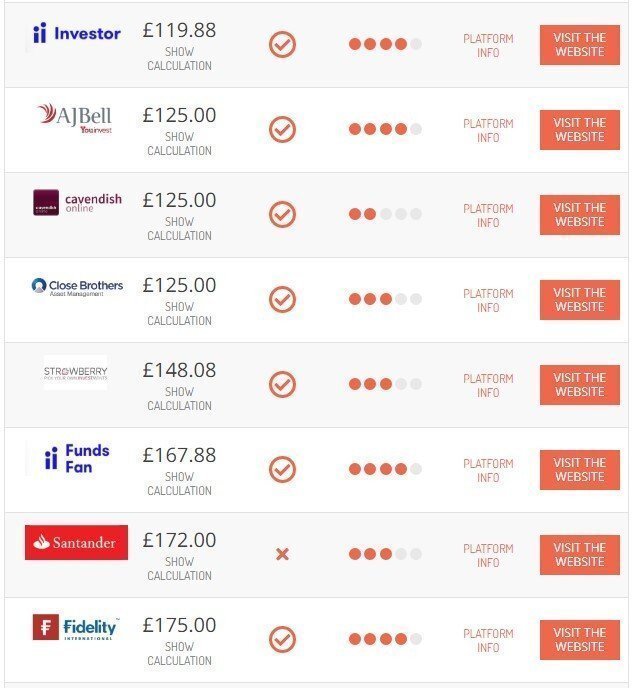

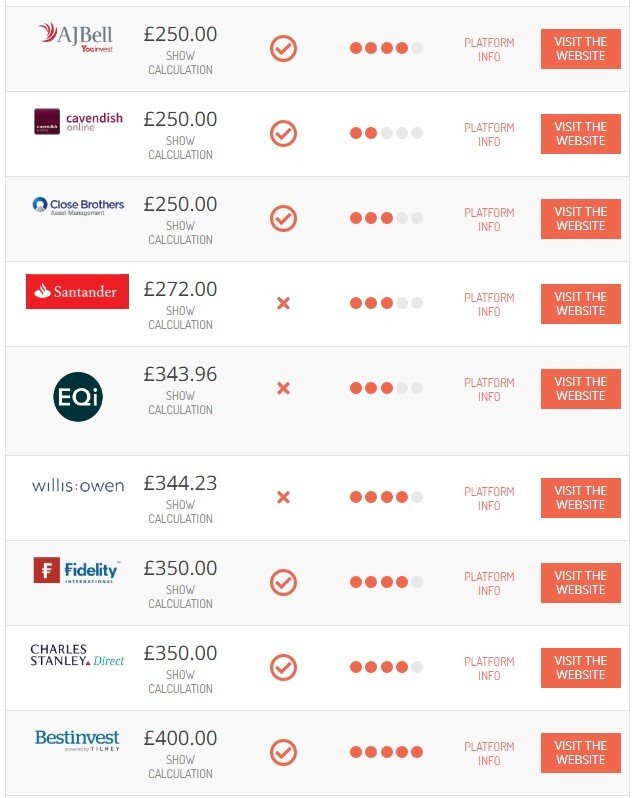

There’s a lot to like about the far superior Fidelity service, so Cavendish clients won’t be disappointed in that regard. However, the premium service comes with a price hike — currently Cavendish clients pay 0.25% for portfolios below £200,000 (0.20% above this amount), but Fidelity’s pricing starts at 0.35% up to £250,000 then drops to 0.20%. It also has an annual product charge of £45.

For an ISA of £50,000 the price difference between the two platforms is £50 per year, and for an ISA of £100,000 the difference is £100 — the larger the portfolio, the larger the difference and that’s excluding any trading charges. Cavendish clients will be kept on the same price for a year, but after that the fees will rise to the Fidelity price. Fidelity is clearly hoping that investors think they’re getting good value. Time will tell.

Photo by Eric Prouzet on Unsplash