Welcome back for the third instalment of Dude, where’s my pension? where we’ll build on what we’ve learned so far to help us understand charges and performance. If you’re joining us for the first time, you can check out blog one and blog two as well.

So far in the series, we’ve looked at how to find out where your pension is invested and how your pension works. This time, we’ll cover how to find out the charges you pay and check on performance. We’ll tackle charges first.

Charges

As we mentioned in a previous blog, every month a slice of your salary goes into your pension and this is then invested on your behalf. Your pension scheme provider will then provide an update, normally once a year, of how your pension has performed. Typically, you’ll be charged by the pension scheme for investments and pension administration and there may be some occasional one-off costs too.

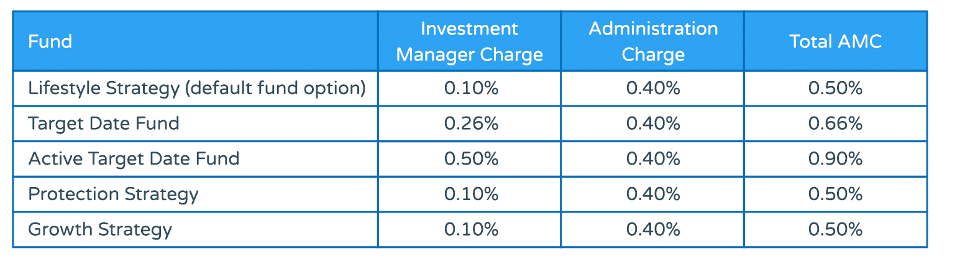

Often administration and investment charges are combined and called the Annual Management Charge (AMC). If you’re in a workplace pension through auto-enrolment (we covered this in the first blog), the government capped the charges you pay at 0.75% a year.

Here’s an example of how the AMC is explained by Nest.

This means that every year 0.3% of the value of your pension would be taken by the scheme to pay for the management of it. Using this example, the charge would be 30p for every £100 invested.

How easy was it to find charges for my friends’ pensions?

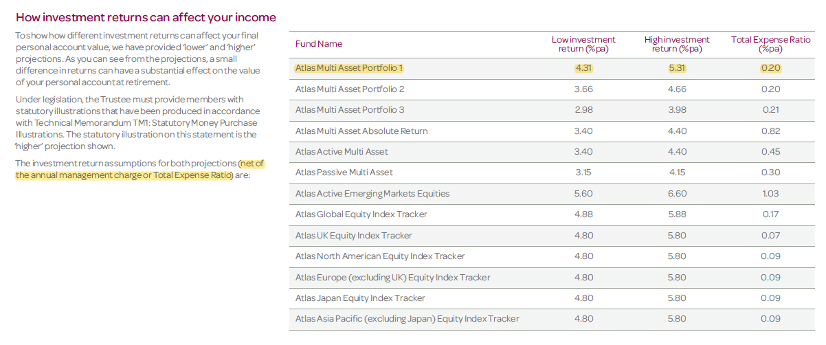

Consistent with what we’ve seen so far, not every pension scheme provides this information in the same way, though some do it better than others. First up, Atlas.

Atlas (the bad)

My friend George’s pension statement summarised his current pension value, how much it had grown since the last statement, and gave a projection of what his pension might be worth in future. It wasn’t until we got to page 13 of this 16-page document, that we found his pension fund charges. Confusingly, Atlas interchanged the terminology and charges were referred to as either an annual management charge or a Total Expense Ratio, which isn’t the same thing.

There was no explanation of the difference in the statement, but being the inquisitive type, George found a supporting document which apparently explained the charges. This 31-page document confirmed the total expense ratio was the cost of the administration charge plus the investment charge.

The document included two pages of explanation and then a further 29 pages of different examples of the impact of the charges on the value of the pension as it grows. None of the scenarios were relevant and after a huge amount of time trying to work it out, George lost the will to live and gave up. The costs were quite low but this information isn’t shown in an easy-to-understand way.

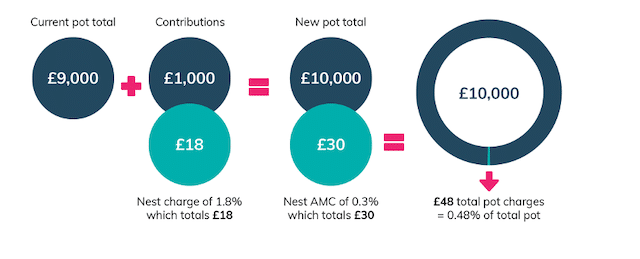

Nest (the good)

The government-backed Nest scheme is one of the fastest growing auto-enrolment workplace pension providers and now looks after £10bn of UK workers’ pensions. Details of the charges are explicit and clear. If you google ‘Nest pension charges’ the first hit will take you to exactly where you need to go. Here’s what it says about charges:

‘We have the same low charges for all members. This stays the same whether a member is contributing or not, whatever fund they’re contributing to, and no matter how much is in their retirement pot.

These charges are made up of two parts:

- a contribution charge of 1.8 per cent on each new contribution into a member’s retirement pot

- an annual management charge (AMC) of 0.3 per cent on the total value of a member’s fund each year’

We think a few workplace pensions providers should adopt this clearer way of explaining charges. The language is simple and less open to the wrong interpretation. Below this text are several examples of how charges are deducted. Like this one:

You’ll have noticed that Nest charges for processing contributions. Some schemes charge to process some transactions, and these should be listed in the charges section but if you’re unsure how they work, get in contact with your scheme (or us!).

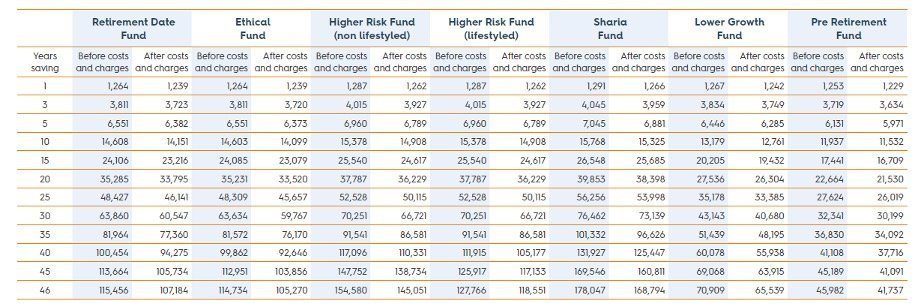

Nest also publicly provides some examples that show the effect of its charges on the value of the pension over a number of years. The values are based on a typical Nest pension pot, but for members of different ages. Here’s how Nest charges affect the value of a 22 year old’s pension. It’s clear to see how the value changes before and after charges.

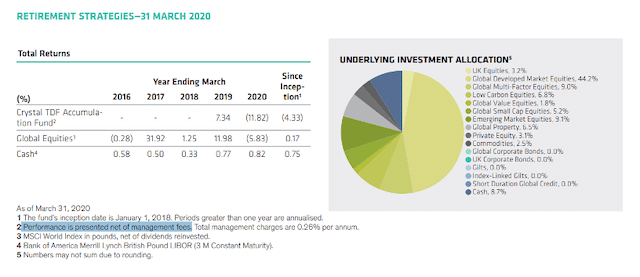

Crystal (the not so crystal clear)

We found Crystal’s charges easily. There’s a simple document that outlines the charges. The annual management charge is split into the charge for the investment and the charge for the day-to-day administration. What we weren’t able to see was the effect of the charges on the value of the pension in future, like Nest has done.

Performance

So how do you know if your pension is performing well? It’s a tricky question but the simplest way to boil it down is whether it’s outperforming, underperforming or in line with similar investments – known as the benchmark.

Performance and charges go hand in hand because charges affect the growth you get. If for example, your pension fund grew by 5% but your charges are 1% then you get 4% growth. We’ve made a simple short video which explains how this works.

Most workplace pensions help illustrate the effect of charges by showing the performance after fees have been taken (the actual growth). It’s important to note that although performance shows how well a fund has done in the past, it is no guarantee for how it’ll perform in future.

Nest (the good)

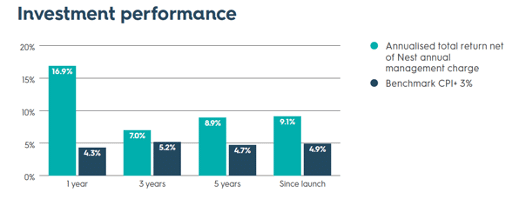

Nest publishes a publicly available quarterly summary of fund performance. There is a summary for each fund, outlining where it’s invested, what it’s trying to achieve (often called the fund objective) and a review of its performance.

The graph above is for the default pension fund, which is aiming for investment returns equivalent to consumer price index (CPI) plus 3% after charges. The CPI is measures inflation, so this fund is aiming to achieve returns of 3% above inflation after charges have been deducted. You can see from the graph that the fund has outperformed its benchmark consistently. Once again, a clear explanation from Nest. Top marks.

It’s worth discussing the notion of benchmarks in a bit more detail. A benchmark is usually an index of some kind like the CPI, or the FTSE 100 which tracks and measures the performance of the top 100 stocks on the London Stock Exchange, or it could be the average of every fund in that particular sector. On that basis, it means that half the funds in a sector will have performed better, and half will have performed worse.

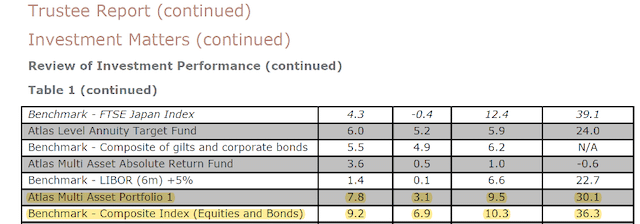

Atlas (the bad)

Unfortunately, we couldn’t find details of my friend George’s pension fund’s performance in his Atlas documents. We did however find a document online provided by the trustees (the people that run the pension fund) that listed the performance of all the Atlas pension funds.

So once again we’re forced to look for his fund in a long list of others. When we finally found it, it had underperformed against the benchmark and this was even before fees had been deducted. Hopefully there’s a simpler, customer-friendly version of this document, but we couldn’t find one.

Crystal (the not so crystal clear)

My friend Amy is invested in Crystal’s default pension fund, the Target Date Fund. We couldn’t find information on the performance of the fund in her statement, but we did find something on the fund fact sheet, which was available online.

As you can see there’s only a couple of years of performance figures available for this fund, and, after charges have been taken the fund has underperformed against its benchmark (Global Equities).

What we’ve learned and what you can do

What’s become clear through this series is that there’s a large difference in the quality and content in the member information that schemes. My friends were trying to analyse their pensions for the first time and had three very different experiences. After reviewing the documentation, here’s what my friends would like to see in their pension statements:

- Show me where my pension is invested

- Show me how I pay for charges and personalise it for me

- Show me how well my pension has performed against the average

- Show me the difference between what I have invested and what I have in my pot (the growth)

- Show me what it might be worth in the future

- Use simple language and illustrations to help me understand

All of this should be displayed in as simple language as possible, with jargon explained clearly. Pension documentation has come a long way, but there’s still work to be done. If you’ve had trouble navigating your pension documents, you can give your schemes a hard time and force them to improve with the following queries:

- Where do I find how much my pension costs? I don’t want to hunt through reams of irrelevant examples and explanations.

- Please only show my relevant pension information. If I’m not invested in it, don’t include it in my statement.

- Please simplify the language and content to make it easier for me to understand (give examples)

- Can you show me how my pension has fared compared to the benchmark?

- Can you show me how much is in my pension and compare it to how much was paid in.

Similarly, we’re on hand to help you if you’d like us to. You can send us your pension statements and we can talk you through any bits you’re unsure of. We’re independent and won’t charge for helping you, and we’ll blog about your experience because we want pension providers to pull their socks up and improve! Don’t worry, we won’t use any personal information; we’re GDPR compliant and registered with the Information Commissioner’s Office. You can get in touch through [email protected].

Conclusion

This is the last in the series of Dude, where’s my pension? but we’ll do some special editions to tackle specific subjects and if readers submit their pension statements, we’ll blog about those too. If you’ve followed the whole series, you’ll now know:

- how your workplace pension works

- how to find out where your money is being invested

- how to find out how much you pay in charges

- how to find out how it’s performed

Hopefully you’re more engaged with what is likely to be the biggest investment in your life apart from your home. With the knowledge in these blogs you should feel be able to challenge your provider if the information is incomplete, or the performance of your pension fund isn’t in line with objectives. After all, they’re working for you.