Understanding LISA interest rates: a comprehensive guide

Understanding LISA interest rates is crucial for individuals looking to make informed d...

Barclays and its new D2C investment platform has attracted lots of attention, but does it stand up to scrutiny? It’s a bold move that takes D2C investment platforms to a new level. In effect, Barclays banking customers will be able to seamlessly access investment products and solutions alongside their current and savings accounts, with one set of credentials.

The new site is being rolled out to existing banking customers, but later in the year it will be available to non-Barclays customers. The Bank has called it Smart Investor and Barclays Direct Investing, but its formal name has still to be decided. For the purposes of this review, we’ll be calling it Barclays New.

The new investment platform is a revamped and enhanced version of the Barclays Stockbrokers platform. According to Barclays, around 91% of their clients will be better off under the Barclays New pricing. The current stockbroker site is geared towards trading, but the new site promises to be a more rounded website with services for all types of investors.

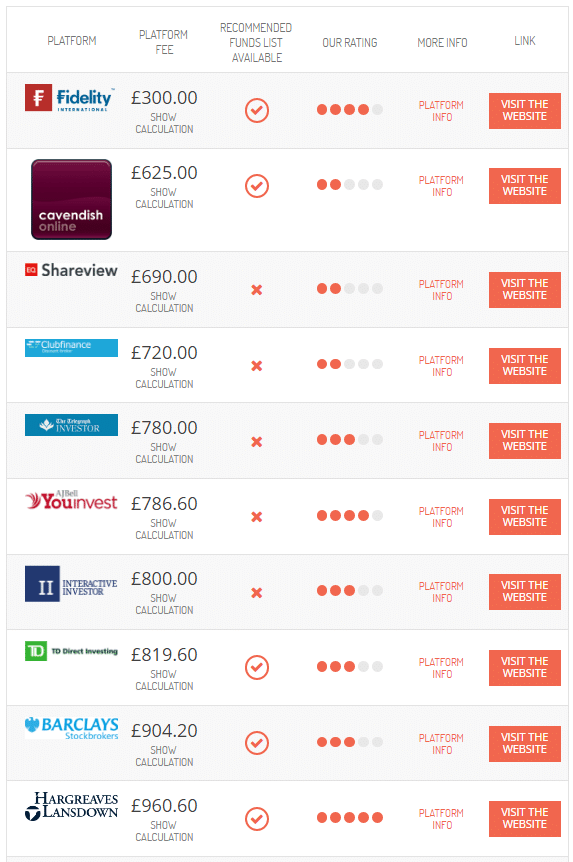

We ran a number of scenarios using our CompareThePlatform, to see if their claim stands up to scrutiny and how they compare to their peers. The scenarios are as follows:

Scenario 1: £15,000 in funds (ISA), trading funds 5 times a year.

Scenario 2: £75,000 in funds (ISA). No trades during the year.

Scenario 3: Total investments of £50,000 (GIA) with £20,000 in exchanged-traded instruments. 20 trades in both funds and exchange-traded instruments.

Scenario 4: £150,000 in funds (GIA), trades funds 10 times a year.

Scenario 5: Total investments of £150,000 with £50,000 in ISA and £100,000 in GIA all of which is in exchanged-traded instruments. 20 trades in both funds and exchange-traded instruments.

Scenario 6: Total investment of £250,000 split as follows: £100,000 in ISA and £150,000 in GIA, with £100,000 of that in exchange-traded instruments. Trades twice a month (24 times during a year).

Scenario 7: Total investments of £250,000 all of which is in exchanged-traded instruments. 10 trades a year.

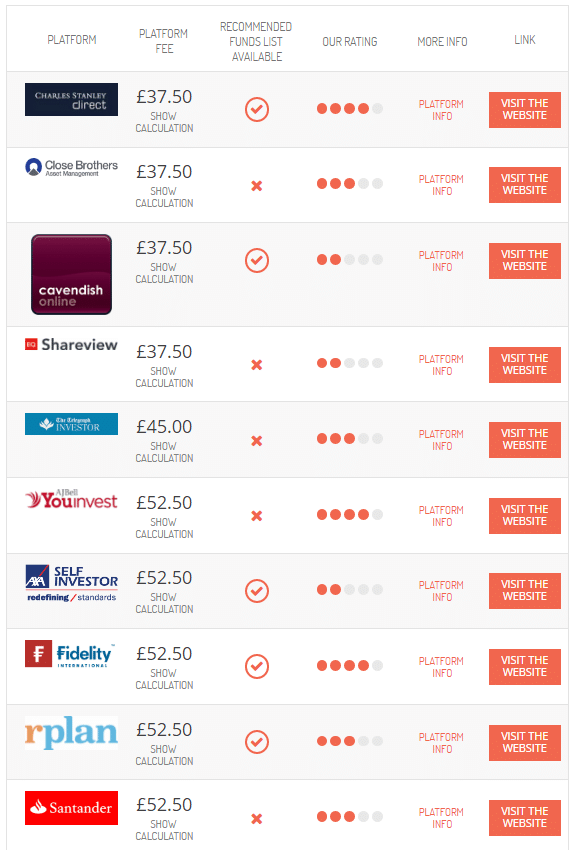

Scenario 1: £15,000 in ISA, trading funds 5 times a year

In this scenario there’s a cluster of platforms with an all-in fee of £37.50 at the top of the ranking (Charles Stanley Direct, Close, Cavendish and Shareview), but Barclays doesn’t appear until 17th place – even Hargreaves Lansdown is cheaper. Barclays New is clearly not designed to compete at the bottom end of the market.

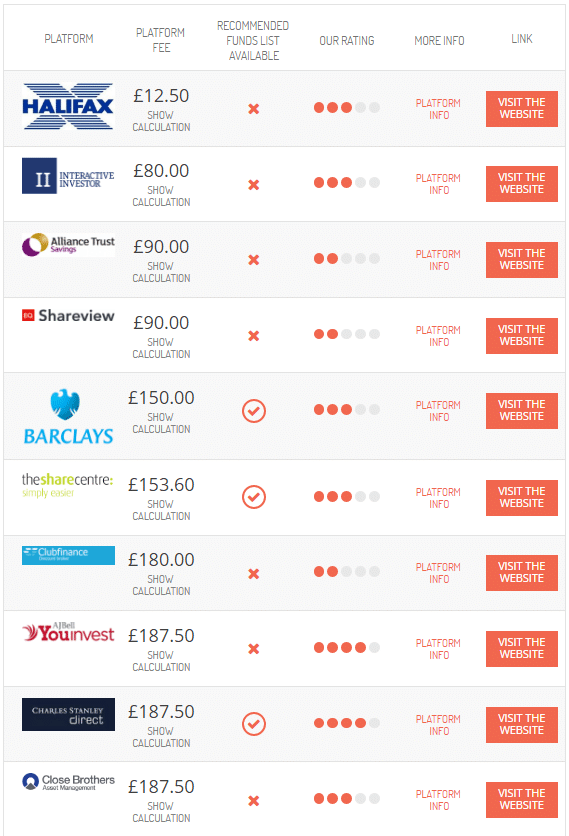

Scenario 2: £75,000 in funds (ISA). No trades during the year

In this scenario Halifax is the cheapest at just £12.50 for holding an ISA, while Barclays New has moved into 5th place with an annual fee of £150. For an investor looking to just buy and hold an ISA, Barclays is in the top 5. The four platforms ahead of it are not very intuitive to use, so Barclays could be on to a winner in this scenario.

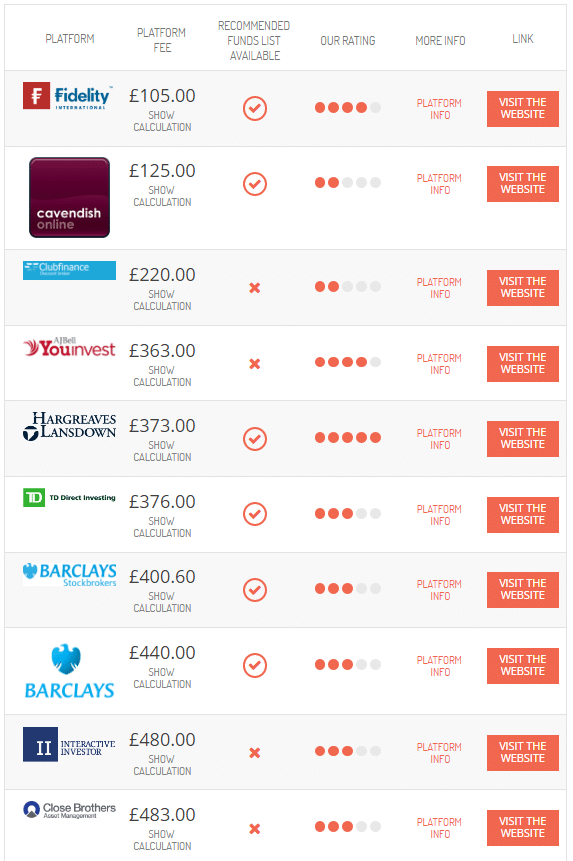

Scenario 3: Total investments of £50,000 (GIA) with £20,000 in exchanged-traded instruments. 20 trades in both funds and exchange-traded instruments

Fidelity is the cheapest in this scenario with fees of £105 while Barclays New is 8th with annual fees of £440 — about £40 more expensive than its own Stockbroker service! The custody fee is lower, but dealing in both funds and exchanged-traded instruments has a big impact on the overall cost (dealing costs are £360 for Barclays New v £238 for Stockbrokers). From the way the pricing has been calibrated, it looks as though Barclays wants to focus on all-round investors and not just day-traders and stockbroker nerds.

Scenario 4: £150,000 in funds (GIA), trades funds 10 times a year

In this scenario, Barclays New appears in 9th place with fees of £360 a year — £223 cheaper than its stockbroker service. The biggest DIY platform, Hargreaves, appears way down the list in 26th position and is £315 more expensive than Barclays. For a bigger portfolio with lower trading activity, the new Barclays platform is in the top 10 and will be easier to navigate than some of the platforms ahead of it.

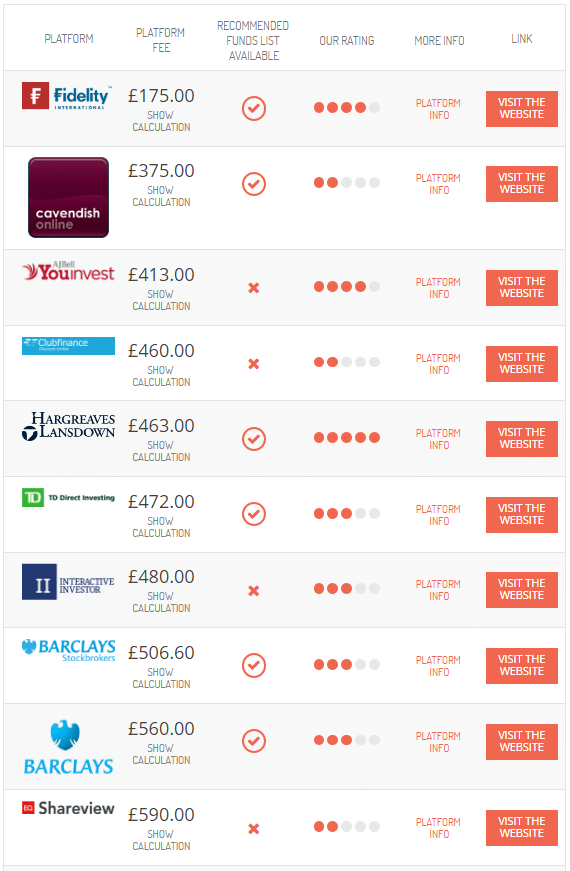

Scenario 5: Total investments of £150,000 with £50,000 in ISA and £100,000 in GIA all of which is in exchanged-traded instruments. 20 trades in both funds and exchange-traded instruments

Fidelity takes top spot with an annual fee of £175. Barclays New is 9th costing £560 a year, and once again it is more expensive than its own Stockbrokers service. Both Youinvest and Hargreaves are higher in the rankings. Fidelity is the cheapest in this scenario but it’s worth noting that it only offers ETFs and does not offer access to direct equities and bonds.

Scenario 6: Total investment of £250,000 split as follows: £100,000 in ISA and £150,000 in GIA, with £100,000 of that in exchange-traded instruments. Trades twice a month (24 times during a year)

In this scenario, Barclays New can be found in 11th place with annual fees of £976 — more expensive than Youinvest, TD Direct and Hargreaves. Fidelity takes top spot once again. Again, it reinforces the view than Barclays is broadening its service from a pure stockbroker approach to a more all-round service that appeals to all types of investors.

Scenario 7: Total investments of £250,000 (GIA) all of which is in exchange-traded instruments. 10 trades a year

In the 7th scenario, Youinvest is the cheapest option with annual fees of £129, while Hargreaves comes second and costs £191 less than Barclays New. Barclays does not appear until much later in the rankings (13th) place with annual fees of £370. Again, it is more expensive than Stockbrokers.

Conclusions

It is clear that Barclays wants to move away from offering services purely for active traders and wants to focus on all-round investors. In the above scenarios, the Barclays New platform is in the top 10 for total annual costs in 4 out of 7 scenarios. When looking at how it compares to Barclays Stockbrokers, the new platform is more expensive in 4 out of 7 scenarios (but not necessarily the same scenarios where it is in the top 10).

The fact that the service will be available through the normal online banking site, and customers having one set of credentials for access, is a compelling feature. At the moment, the new platform is only available to existing banking customers. It is expected to be launched for all investors this summer. If you would like to run your own comparisons, click here.