Understanding LISA interest rates: a comprehensive guide

Understanding LISA interest rates is crucial for individuals looking to make informed d...

The latest addition to CompareThePlatform is Retiready, the direct-to-consumer platform launched in 2014. Retiready is owned by Aegon, the life insurance and pension provider. We had a look under Retiready’s bonnet and poked around at its investments and the consumer tools on offer.

Retiready offers a basic pension and Stocks and Shares ISA proposition. Investors have access to a restricted range of funds — a maximum of five funds in the pension account and a maximum of four in the ISA. All the funds on offer are by BlackRock. In addition, Retiready does not offer access to shares, bonds or other exchange-traded instruments.

The platform is geared around a ‘Retiready’ calculator which scores users from 1 to 100 based on the level of current income and savings, as well as their expected retirement age and desired income at retirement. This goal planner is very easy to use and the score is designed to show investors whether they are on track for their goals or they need to make some changes.

Other tools include a risk profiler and a lifestyle planner that takes into account the effect of inflation, allowing users to quantify their future spending in today’s money. There is also a selection of information videos about retirement and retirement planning. Overall, it’s is easy to navigate and it works well across a range of devices.

So, how much does it cost?

Retiready charges a platform fee of 0.5% on assets up to £50,000, 0.4% for assets of between £50,000 and £100,000 and 0.3% on assets over £100,000. Fund charges are as high as 0.82%. There is no charge for switching funds.

To give you an idea of the overall cost, we ran a few scenarios in our platform calculator. We looked at various scenarios below. In each case we have assumed buy and hold, so there is no fund switching or dealing costs and all the calculations exclude fund charges.

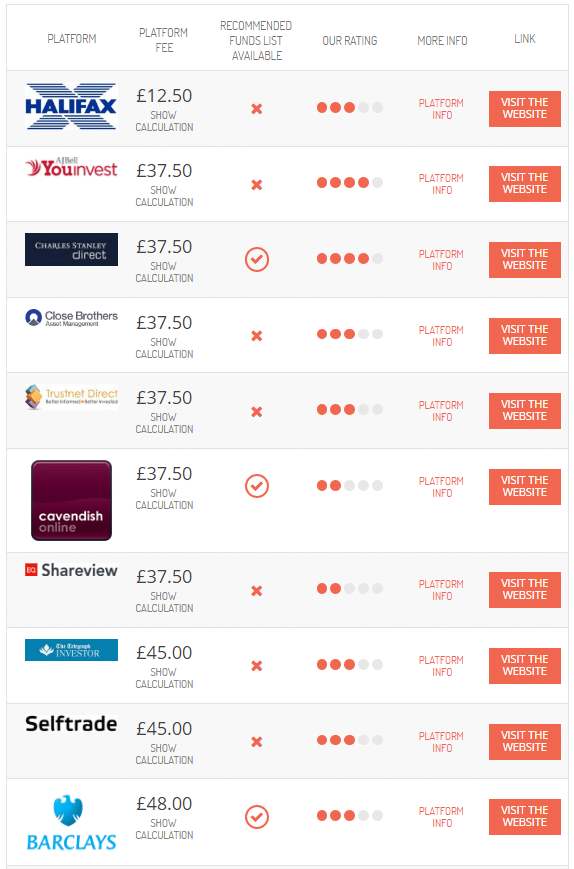

Scenario 1: £15,000 in ISA

In this scenario, Retiready is in 21st place with annual fees of £75, comparing unfavourably with the likes of Youinvest and Charles Stanley Direct that have considerably more choice and research tools available.

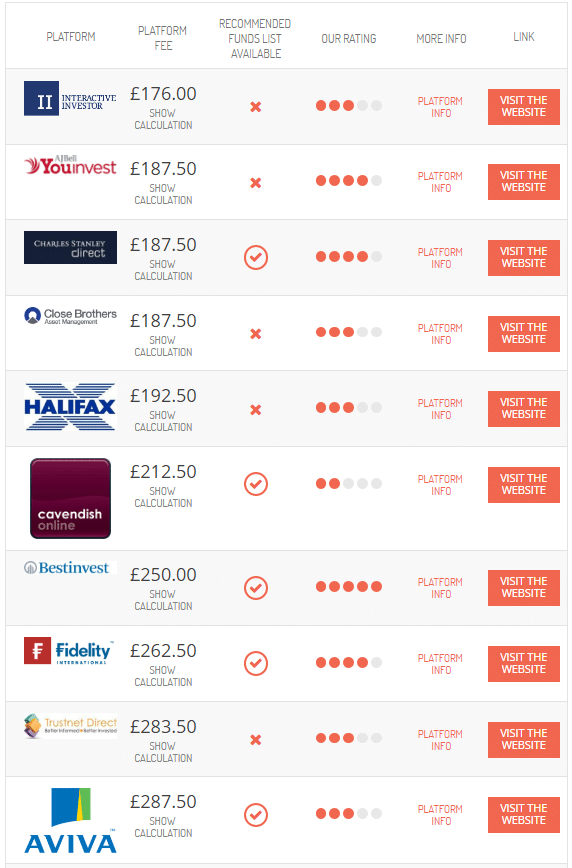

Scenario 2: £25,000 in ISA and £50,000 in SIPP

The cheapest in this scenario is Interactive Investor with an annual fee of £176. Retiready comes 16th and costs £350.

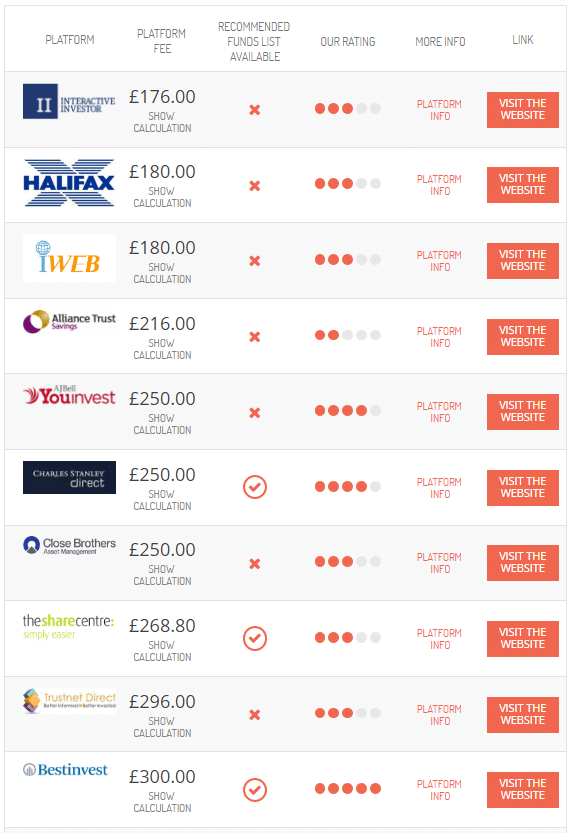

Scenario 3: £50,000 in ISA and £150,000 in SIPP

Retiready is again at the more expensive end of the market, in 18th position. It is, however, cheaper than the biggest DIY platform, Hargreaves Lansdown. But of course it can’t compete with Hargreaves on the range of research tools, product and investment range etc.

Scenario 4: £100,000 in SIPP

Retiready is 18th with an annual fee of £450, which is roughly the same as Hargreaves Lansdown.

Conclusion

Retiready offers a restricted investment choice so the focus seems to be on new and less experienced investors who are looking to build up their retirement funds. Based on our calculations for the above scenarios, Retiready is a fairly expensive proposition for investors. It’s worth noting that trading hasn’t been included, and dealing charges can have a significant impact on the overall platform cost.

Aegon has positioned Retiready as a tool for advisers and employers to look after their customers or employees. The aim of the service is not to go head to head with platforms like Hargreaves and Fidelity and Interactive Investor, but to help advisers stay in touch with customers whose assets are too modest or for whom the advice service might be too expensive. If and when these customers eventually need advice, the adviser relationship will have been maintained.

To run your own platform cost scenarios, click here.