The Global Financial Crisis of 2007 and 2008 is something that none of us will ever forget. Financial institutions collapsed and countries around the world were plunged into recession. Some had to be saved from bankruptcy.

What followed were almost ten years of uncertainty, crisis and severe austerity measures. It’s taken a long time to recover and arguably some countries are still suffering the effects. But although it may be hard to believe, the Global Financial Crisis also brought about some positive change in the world of finance.

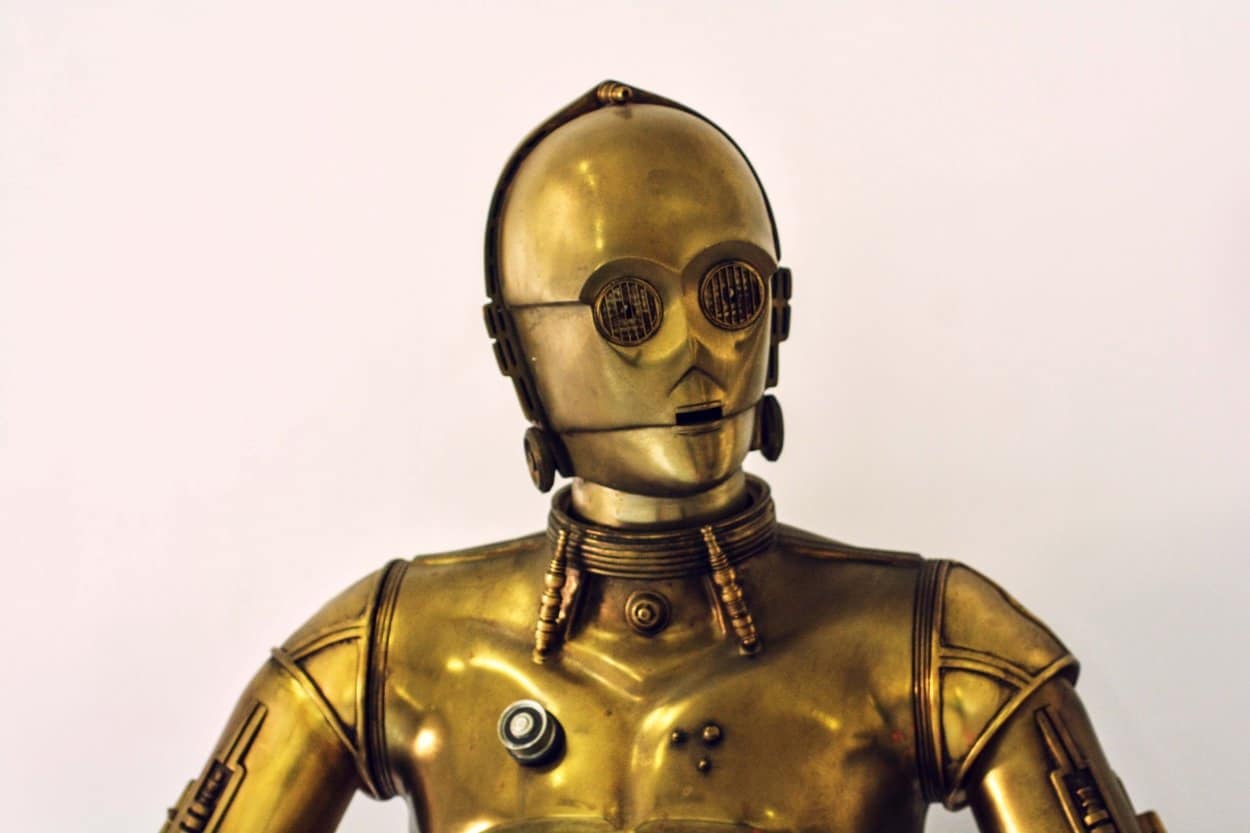

As well as stricter regulation, 2008 also gave birth to robo-investors, also known as robo-advisers or online direct investment managers. If you’re looking for an easy way to invest, robo-investing could be a great place to start, but make sure you understand how it works.

What is robo-investing?

There are three main ways to invest. Do It Yourself – you pick your investments yourself, Do It With Me — your financial adviser recommends investments to you, and lastly, Do It For Me — you hand over the responsibility to a wealth manager. Do it for me has traditionally been the most expensive way to invest, but thanks to the use of algorithms, robo-investing is now an affordable and effortless way to invest and have your money managed by experts.

Essentially, with robo-investing you can become an investor with just a few taps (or clicks) and you don’t need to be super rich or knowledgeable about investing to get started. Many robos let you invest from as little as £25 per month, and they’re designed to do the hard work for you. All you need to do is choose how much you want to invest and select the risk level that suits your needs. On most robos, this is done through suitability and risk questions that help them decide your risk tolerance.

Robo-investing is also about transparency and control. With online investment managers, you’re in the know and in the driver’s seat as you can check how your investments are doing or top up your plan anytime, anywhere.

Is my money managed by robots?

When we talk about robo-investing, it’s often assumed that robots are calling the shots, but that’s not the case. In the US, some services are fully automated but in the UK, that’s rare. In practice, robo-investors employ algorithms (a set of rules to be followed in a calculation) to process large amounts of information and analyse what’s going on in the markets.

The investment experts, who are reassuringly human, then use that information to decide what to buy and where to invest. The advantage of using technology is that it helps remove human bias from our investing decisions – everything is data-led.

What are the benefits of robo-investing?

The main benefit of robo-investing is that it has opened up the investment world to ordinary investors. Years ago, you had to have tens of thousands to invest with a wealth manager. Nowadays, online digital investment services have democratised investing and opened the gates to everybody. You no longer need to be super rich to become an investor — with some robo-investors, you can even get started with as little as £1!

The other key benefit is that you can invest without having financial knowledge or experience. In fact, you don’t need to know much about stock markets or investment types to dip your toes in the investment world. Investment professionals take care of everything – and by this, we really mean everything. They monitor markets, analyse data, research companies, keep a close eye on the news, and make adjustments to the investment plan if needed, to keep it on track with your investment style.

Robo-investing isn’t just about simplicity, it’s also about affordability. Whether you’re picking your own investments via a DIY platform, hiring a wealth manager to look after your money or opting for a robo-investor, fees are deducted from your investments. Depending on the type of service you’re using, costs can vary. Robo-investor fees include the fee for looking after your investment (often called the custody or platform fee), the fee for the investment plan they have created for you, and the fee for the underlying investments. Altogether, they can range from 0.6% to 1.2% of your overall portfolio.

What are the cons of robo-investing?

Most robo-investors won’t let you pick your own investments – that’s their job. However, that doesn’t mean that you don’t have a say in where your money goes. Robo-investors will normally recommend an investment plan that is aligned to your risk profile, but you can always choose to lower or increase your risk. If you go for more cautious options, you’ll hold a greater portion of safer investments, such as government bonds and your returns will be lower. But if you’re more adventurous, then you’ll be holding more stocks and shares, and your returns will be higher.

Robo-investors use index-tracking funds or exchange-traded funds (ETFs). These have the benefit of being cheaper to invest in than actively managed funds because they replicate the indices they are tracking. But it does mean that when stock markets dip, so too do your investments. (Active fund managers like to argue that they’re able to minimise the impact of any stock-market drops, but it’s not always consistent, and isn’t backed up by long-term statistical evidence.)

Another thing to be aware of is that some robo-investors aren’t regulated to give advice on whether investing is right for you. So, if you want someone to thoroughly examine your financial situation, and tell you what investments to choose, then you might want to talk to a financial adviser. If you have lots of debt like credit cards and loans, then investing isn’t really for you. Some good rules of thumb is to only have good debt (a mortgage for example), at least three months’ of emergency cash savings (more if you have dependents), and to be saving or investing for the long term before you decide to invest. For savings goals of less than five years, you’re better off in cash.

Is robo-investing right for me?

Only you can decide if robo-investing is right for you. It depends on your financial situation, personal circumstances and your personal preferences. Generally speaking, robo-investing can be a good option for people who don’t have time or don’t feel confident enough to pick their own investments. It’s also a great place to start if you can’t afford to invest large lump sums or just want an easy way to put your money to work.

How to get started with robo-investing

Before you join the world of robo-investing, it’s important to do your homework and shop around. Not all robo-investors offer the same service and if you want to make the most of your investment journey, it could be worth comparing what every platform offers. Obviously, it’s a good idea to look at fees, but don’t just focus on that; there are other things to consider, such the investment strategy, their customer service, or the products they offer. Some robos will only offer ISAs or General Investment Accounts, while others have a broader range of accounts such as Sipps, and junior ISAs and Sipps.

We’ve designed a robo calculator to do the heavy lifting for you. You can also see all our robo reviews here.

Once you’ve made your choice, it’s fairly simple to get started. You’ll simply need to sign up, and choose the account type you’d like to open, the amount you want to invest, and the risk level you’re most comfortable with. Most robos will ask you to answer a few questions about your finances and circumstances and then Bob’s your uncle.

Photo by Lyman Gerona on Unsplash