Understanding LISA interest rates: a comprehensive guide

Understanding LISA interest rates is crucial for individuals looking to make informed d...

The press is awash with stories and articles about the pros and cons of passive and active investment, active advice and robo advice, fees and the like. The often wild claims (fake news??) give investors unrealistic ideas about long-term investments and make it difficult for them to make informed choices. Sometimes they do nothing and leave their money to languish in deposit accounts with meagre interest rates. To help investors understand the ins and outs of different investments through different channels, we are running a unique experiment for a year — The Great British Wealth Off.

It’s a difficult world for ordinary savers and investors. Interest rates are still at all-time lows, but inflation is creeping up and that means investors need to take some risk to ensure their hard-earned cash isn’t eroded by inflation. And then there’s the impact of fees — the adviser, the platform and the fund manager all charge a fee, so the investment has to generate enough to cover fees and meet the investor’s realistic growth expectations.

How do investors make the right investment choices? Since the introduction of a law in 2013 requiring investors to pay for financial advice, many investors can no longer access advice because they cannot afford the fees or because there are fewer advisers to help them. Some have turned to DIY investment platforms to make their own investment selections, while others have delegated the task to robo-advisers — online wealth managers that put investment portfolios together using low-cost ETFs or passive funds based on the investor’s risk profile and investment objectives.

We have invested across a range of investments and solutions both passive and active, both advised and non-advised. Each quarter we will give you an update on performance, asset growth and fees with a final review and assessment at the end of the year. All the investments were made on 2nd February 2017 and the Great British Wealth Off is expected to end on 1st February 2018, but will run for a further year if there is sufficient demand.

Our investments

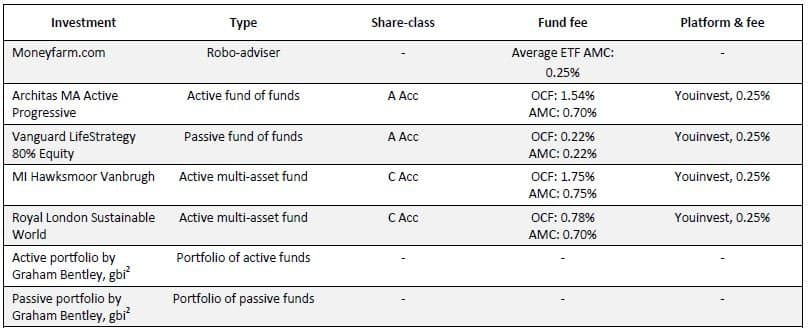

We selected five different investments and started them all on 2nd February: One robo-adviser (Moneyfarm), one active fund of funds (Architas MA Active Progressive), two active multi-asset funds (MI Hawksmoor Vanbrugh and Royal London Sustainable World), and one passive fund of funds (Vanguard LifeStrategy 80% equity). Only funds with the same Morningstar SRRI rating of 4 (out of 7) were selected. On Moneyfarm, we were profiled as a pioneering investor but chose a medium risk level.

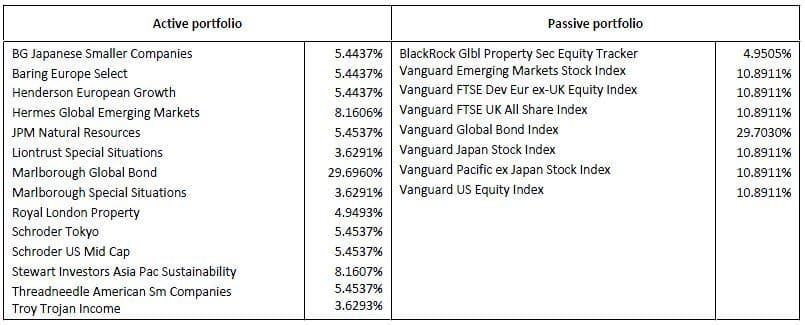

In addition, asked Graham Bentley at GBi2 to put together two portfolios, one active and one passive, to act as control portfolios for our Great British Wealth Off experiment. The control portfolios generated a Morningstar rating of Moderate risk.

Apart from the Moneyfarm portfolio, each investment was replicated with different charging structures: 0.95% for advice fee plus advised platform fee, 0.25% for the non-advised platform fee (in this case AJBell Youinvest platform), and no charge for investing directly with the fund manager. Clean share classes were used except for direct, where we’ve used the charge offered by each fund manager under those circumstances. That’s a total of 19 portfolios that should give a broad and fair comparison of what an investor would actually experience.

Below are the investments we selected and the fees they will generate on on the AJBell Youinvest platform (we made actual investments of £300 into each investment).

Reviews

We’ll be conducting quarterly reviews of our investments on 1st May, 1st August, 1st November and 1st February 2018. If you’d like to be kept informed, follow us on twitter @compareplatform or sign up for the newsletter on our website.

Acknowledgements

We’d like to thank all our investment participants, but in particular Moneyfarm, AJBell Youinvest, Hawksmoor, Architas, Royal London and Vanguard for agreeing to participate in the Great British Wealth Off. We’d also like to thank Graham Bentley for putting together our portfolios. Graham is MD of gbi2 and has 35 years’ experience in the investment business.

Download this post here.

—————————

Notes to Editors:

About Fundscape

Established in October 2010, Fundscape is a research house specialising in the end-to-end research and analysis of the UK fund industry. It is the publisher of the quarterly Fundscape Platform Report, widely regarded as the industry benchmark for platform data and statistics in the UK. With many years’ industry experience, its team is well placed to provide unique insight into asset management and distribution trends, including product development, distribution and marketing.

Web: www.fundscape.co.uk

Email: [email protected]

Twitter: @fundscapeuk

About compareandinvest.co.uk

Compareandinvest.co.uk is a Fundscape brand. It was set up by Bella Caridade-Ferreira, CEO of Fundscape, industry leader in providing reports, analysis and data on the investment fund industry, to provide real-time insight into the costs charged by investment platforms. Launched on 3rd November 2016, compareandinvest.co.uk is completely independent and impartial, with no links to any of the platforms mentioned on the website.

Web: www.compareandinvest.co.uk

Email: [email protected]

Twitter: @CompareinvestUK

For further information or background please contact:

Bella Caridade-Ferreira, CEO

tel: +44 (0)20 7720 1183 or +44 (0)7980 241298

email: [email protected]

Dr Tim Burrows, Research & Data Analytics Manager

tel: +44 (0)20 7720 1183 or +44 (0)7827 294412

email: [email protected]